Bitcoin price prediction: Are miners signaling the next breakout above $120K?

PositiveCryptocurrency

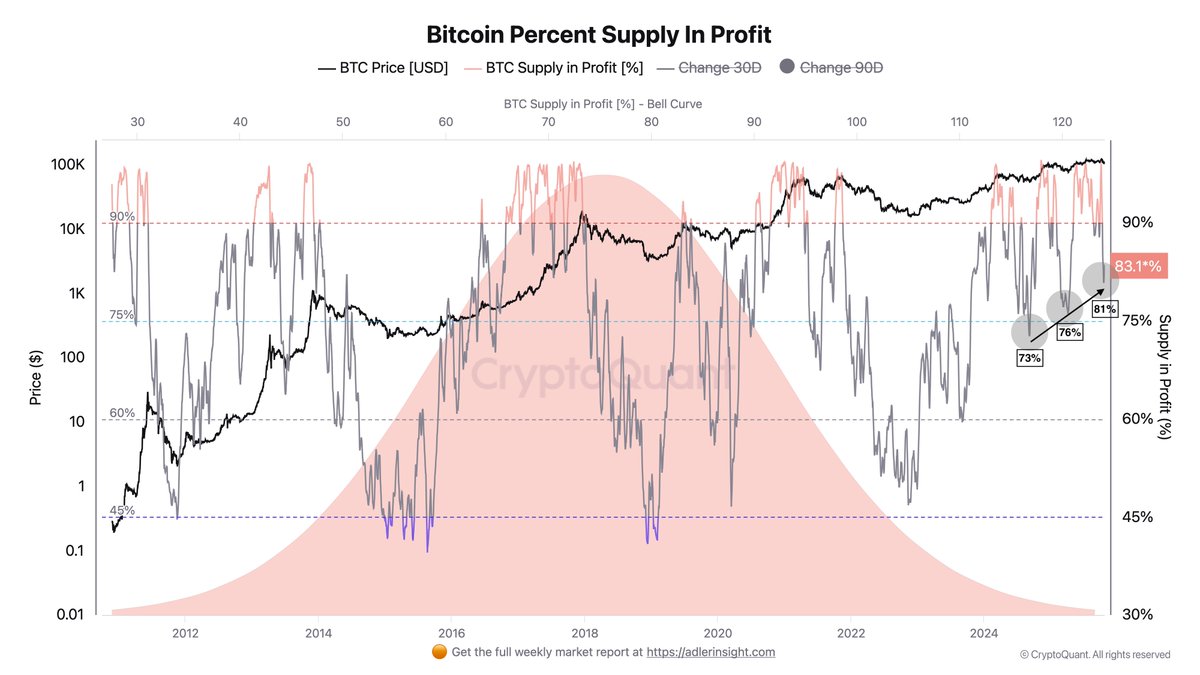

Bitcoin's price is currently hovering around $114,000, showing signs of stabilization as miner reserves recover. This shift is crucial as it alleviates some of the selling pressure that has impacted the market in recent months. With the recent post-halving downturn behind us, many are optimistic that this could signal a potential breakout above $120,000, making it an exciting time for investors and enthusiasts alike.

— Curated by the World Pulse Now AI Editorial System