Here’s What Happens To The Dogecoin Price After The Consolidation Phase Ends

NeutralCryptocurrency

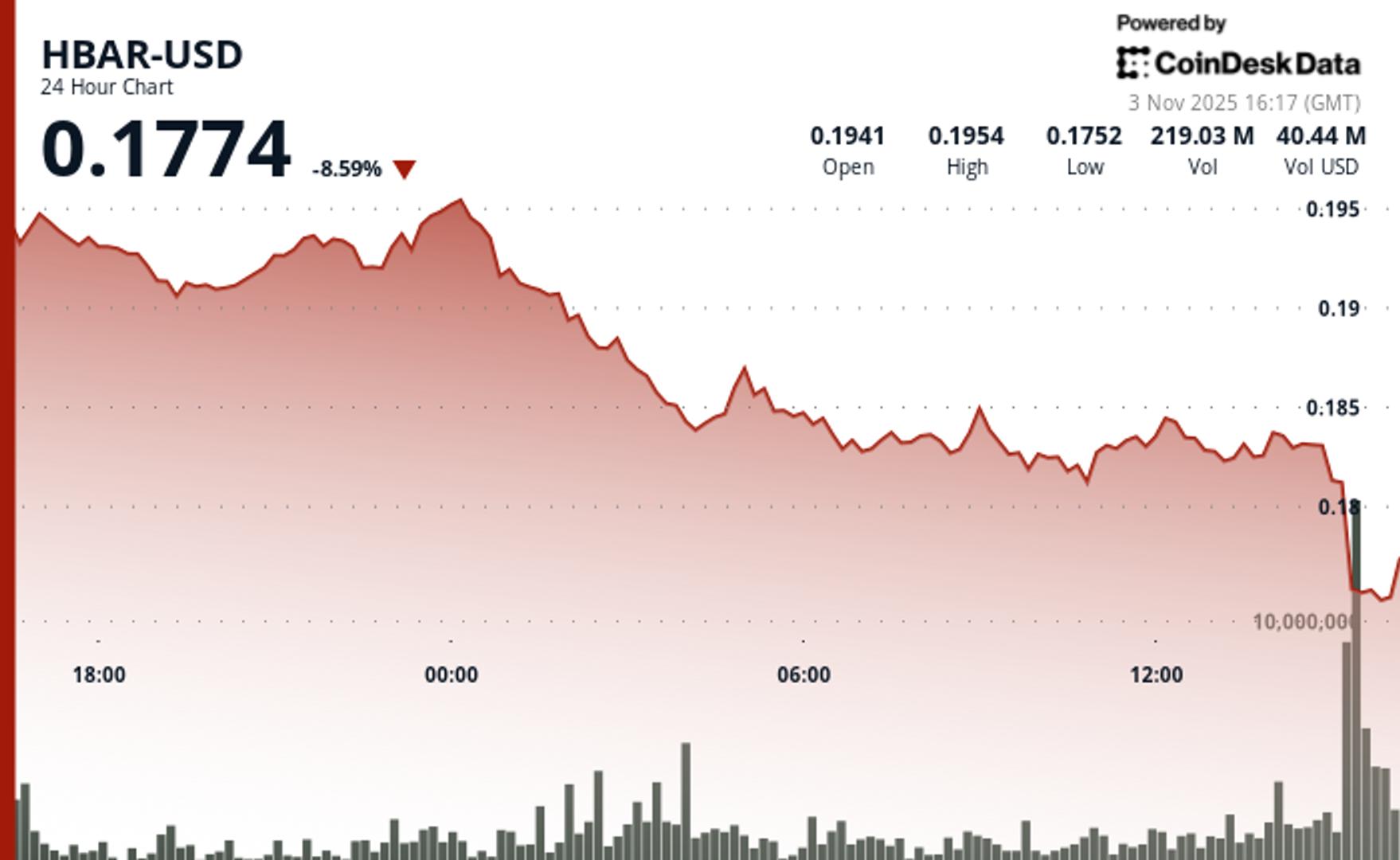

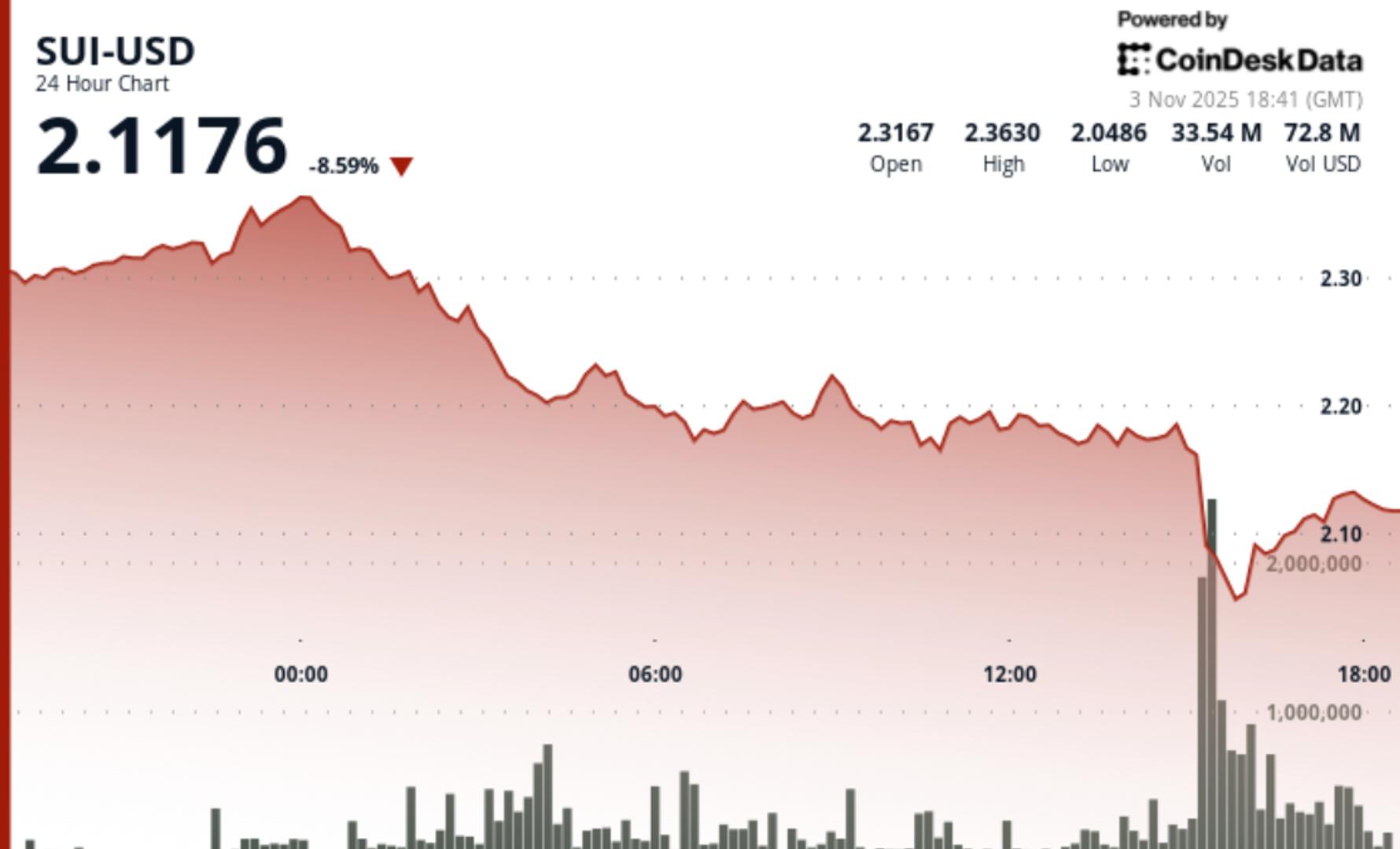

Dogecoin has been experiencing a period of consolidation, fluctuating between $0.17 and $0.18, after failing to break above $0.19. This follows unsuccessful attempts to recover losses earlier in October. Traders are closely watching the situation, as many believe a significant price rally could be on the horizon. Understanding these price movements is crucial for investors looking to navigate the volatile cryptocurrency market.

— Curated by the World Pulse Now AI Editorial System