Vanguard’s Massive Crypto Reversal Triggers ‘Highly Bullish’ Mainstream Momentum

PositiveCryptocurrency

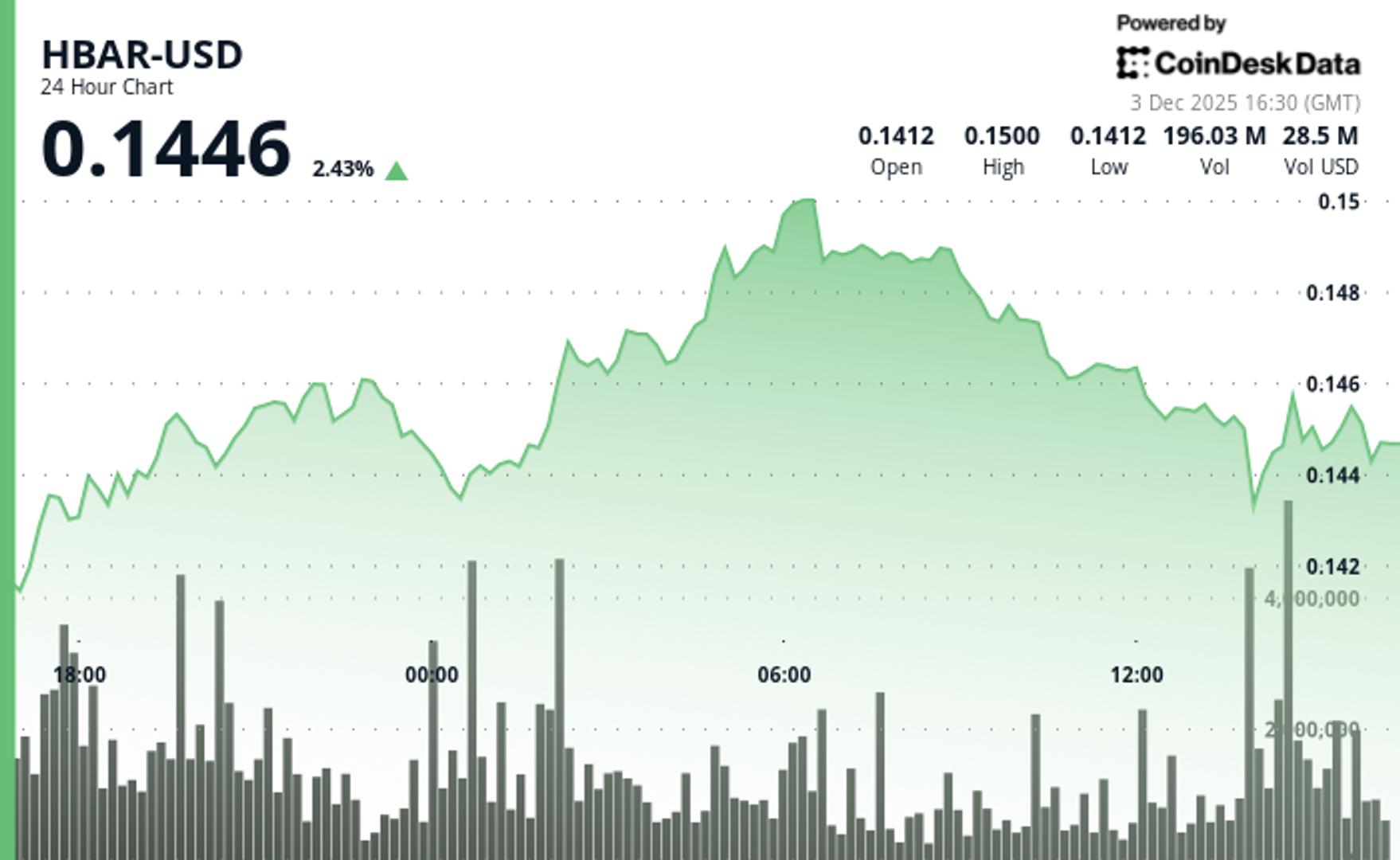

- Vanguard has made a significant shift in its approach to cryptocurrency by launching exchange-traded funds (ETFs) for Bitcoin, Ethereum, XRP, and Solana, which has triggered a highly bullish sentiment in the market. This move comes after a period of volatility in the crypto space, where Bitcoin's price fluctuated significantly, recently rebounding to around $91,000 after a sell-off. Analysts are closely monitoring this development as it could influence broader market trends.

- This expansion into cryptocurrency ETFs marks a pivotal moment for Vanguard, as it positions the firm to capitalize on the growing interest in digital assets among mainstream investors. By making crypto investments more accessible, Vanguard aims to attract a wider audience and enhance its competitive edge in the financial services sector, signaling a shift in how traditional finance views cryptocurrencies.

- The launch of these ETFs coincides with a broader recovery in Bitcoin's price, which has shown resilience despite recent market fluctuations. Analysts suggest that rising investor confidence, coupled with institutional interest from firms like Vanguard, could lead to a more stable and bullish market environment. This development reflects a growing acceptance of cryptocurrencies as legitimate investment options, challenging previous skepticism and potentially reshaping the financial landscape.

— via World Pulse Now AI Editorial System