Bank of America Sees 1%–4% Crypto Allocation Shaping New Paths in Digital-Asset Exposure

PositiveCryptocurrency

- Bank of America has announced a significant shift in its investment strategy, allowing its wealth advisers to recommend a cryptocurrency allocation of 1% to 4% for clients. This marks the first time the bank has opened the door to Bitcoin ETFs for its wealthiest clients, reflecting a growing acceptance of digital assets in traditional finance.

- This development is crucial for Bank of America as it positions itself at the forefront of the evolving cryptocurrency landscape, catering to the increasing demand for digital asset exposure among investors. The move aligns with broader trends in the financial sector towards integrating cryptocurrencies into wealth management strategies.

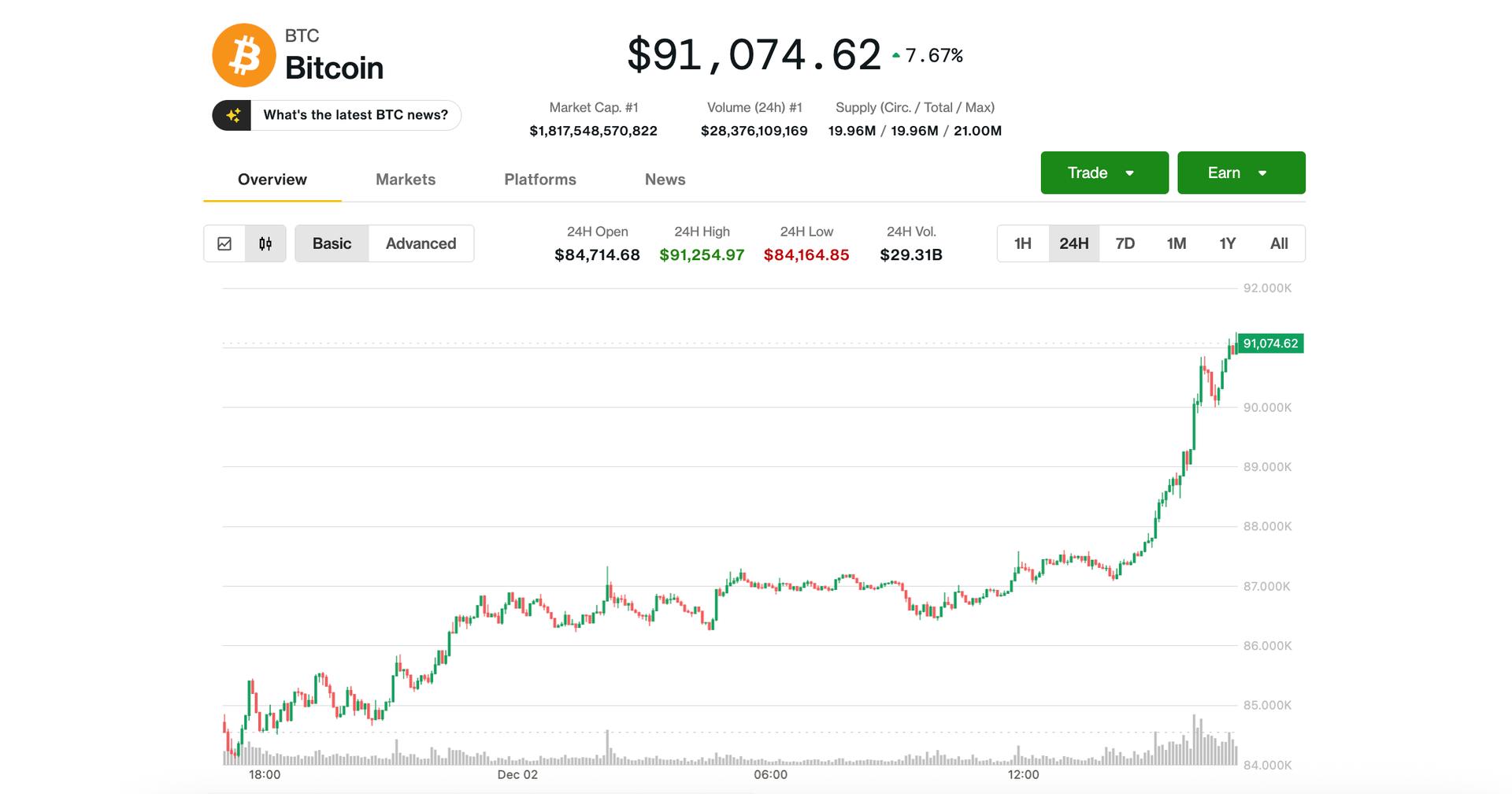

- The recommendation for a crypto allocation comes amid rising confidence in Bitcoin's recovery, as it recently surged above $91,000 after a period of decline. This reflects a broader acceptance of cryptocurrencies as viable investment options, contrasting with regulatory challenges in markets like China, which has intensified its prohibitive stance on crypto speculation.

— via World Pulse Now AI Editorial System