Has XRP Finally Bottomed? Key Support Holds as Wave-5 Breakout Trigger Nears

NeutralCryptocurrency

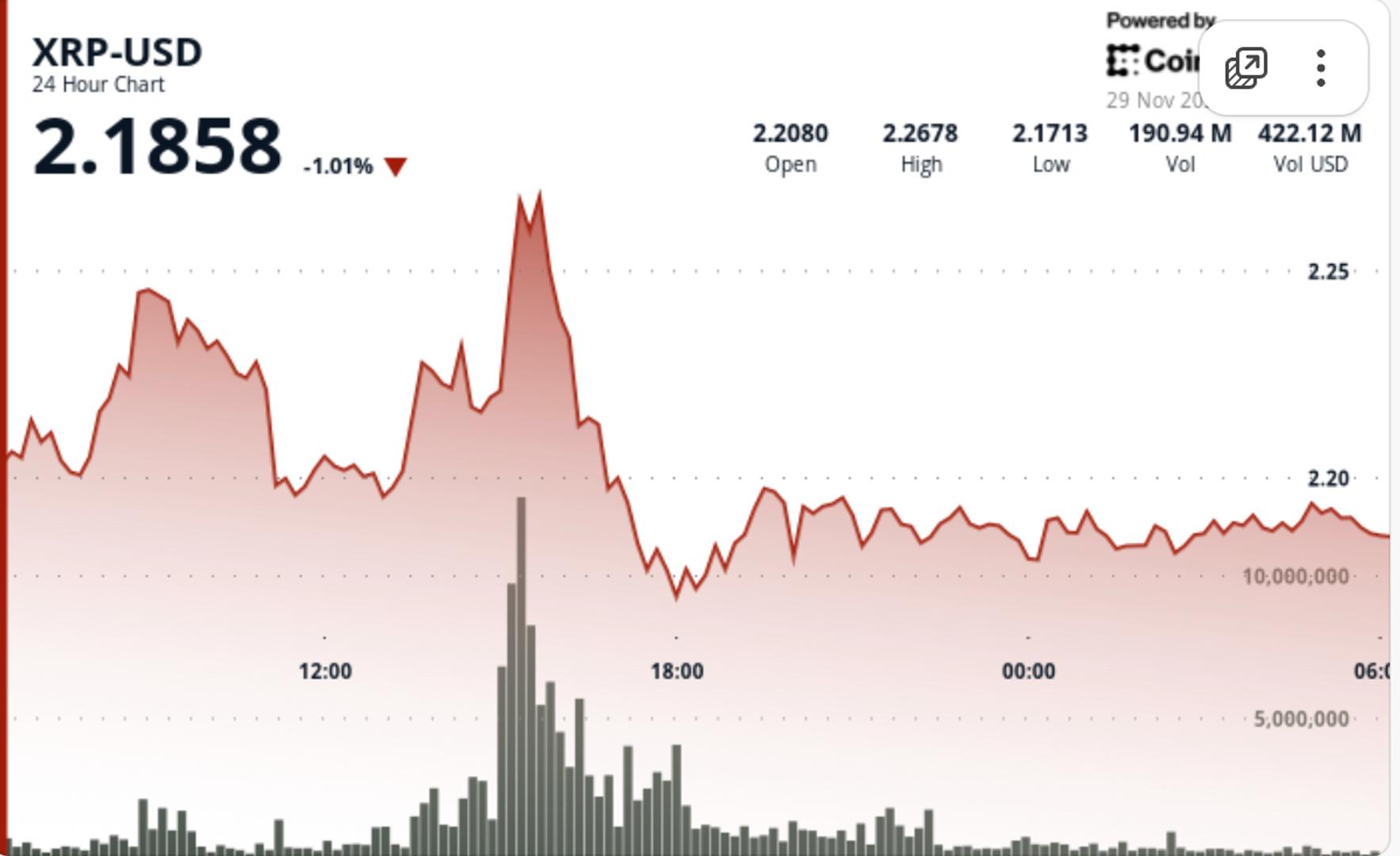

- XRP is currently testing key support levels, with a close above $2.22 indicating a potential bullish trend, while failure to maintain $2.17 could lead to further declines. Recent trading has seen XRP fluctuate within the $2.16–$2.25 corridor, reflecting market volatility and trader caution.

- The performance of XRP is critical as it influences investor sentiment and market confidence, particularly following a notable surge of 6.7% recently. Maintaining key support levels is essential for sustaining upward momentum and attracting further investment.

- The cryptocurrency market is currently characterized by mixed signals, with some analysts warning of potential downside risks while others highlight a V-shaped recovery. The interplay of technical indicators and market sentiment suggests a complex landscape where XRP's price movements could reflect broader trends in the cryptocurrency sector.

— via World Pulse Now AI Editorial System