XRP Faces Downside Risk as Historical Patterns Point to $1.50

NegativeCryptocurrency

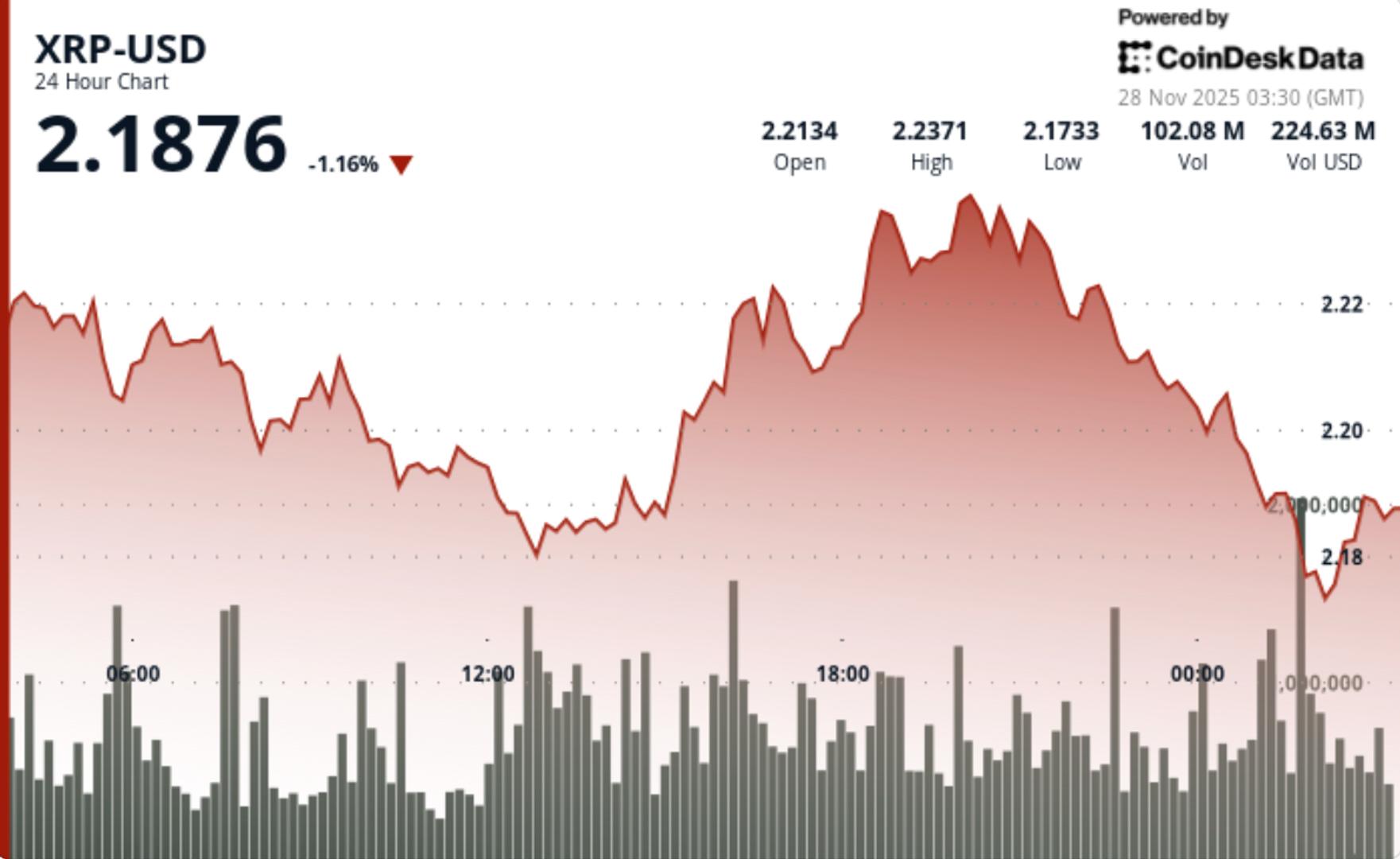

- XRP is currently facing significant downside risk, with historical patterns indicating a potential drop to $1.50. The cryptocurrency has recently seen a decline, trading at $1.81, its lowest since April, as market pressures continue to mount. Analysts suggest that XRP is oversold, but a recovery would require breaking above critical resistance levels.

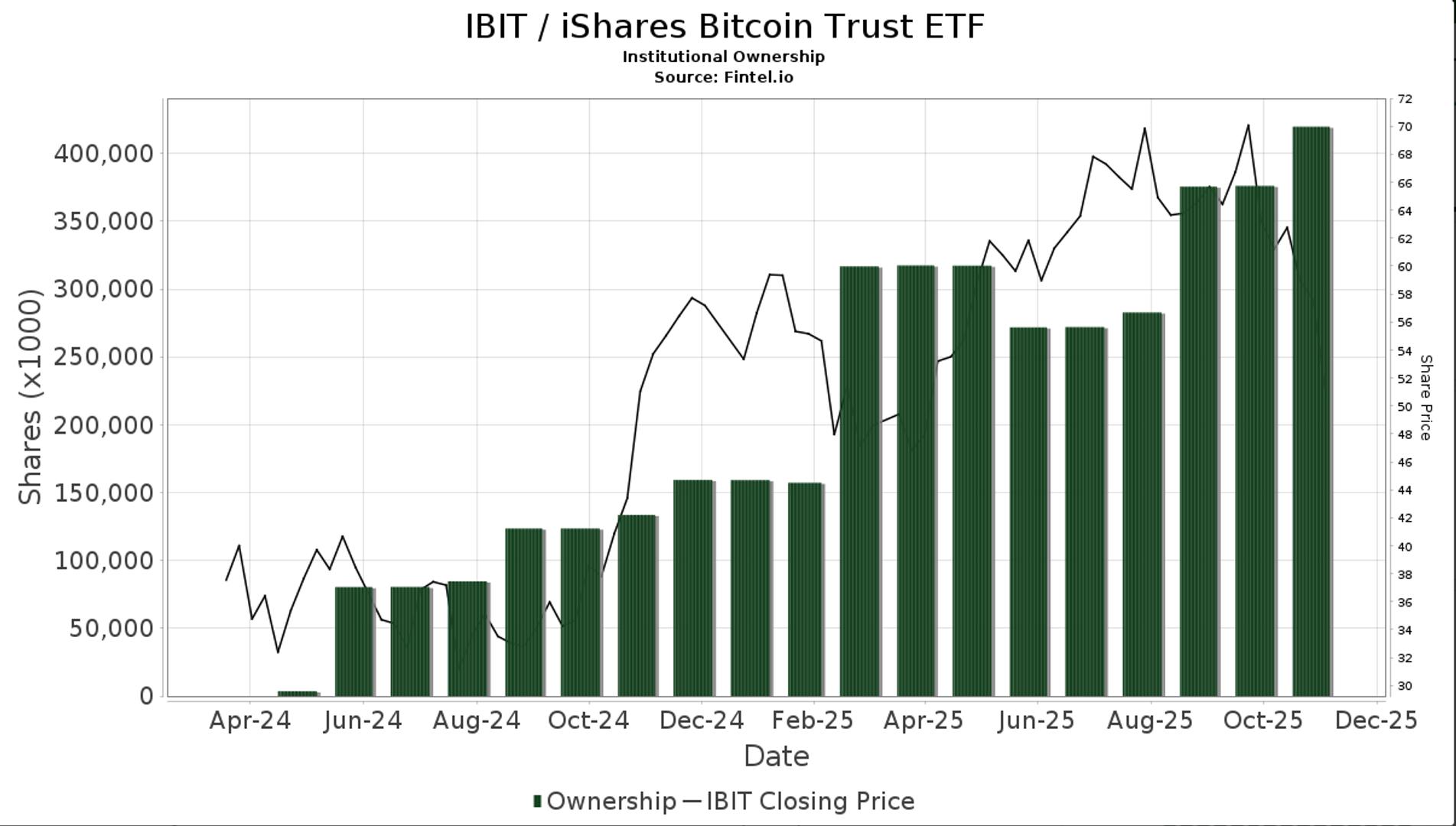

- This decline is particularly concerning for XRP as it reflects broader market volatility and investor sentiment. The recent launch of an exchange-traded fund (ETF) failed to stabilize prices, indicating that external factors are heavily influencing XRP's market performance.

- The situation highlights ongoing challenges within the cryptocurrency market, where Bitcoin's weakness has negatively impacted altcoins, including XRP. Analysts are predicting further price declines, with some suggesting a potential drop to $1 by 2026, as key network metrics show a downward trend and investor confidence wanes.

— via World Pulse Now AI Editorial System