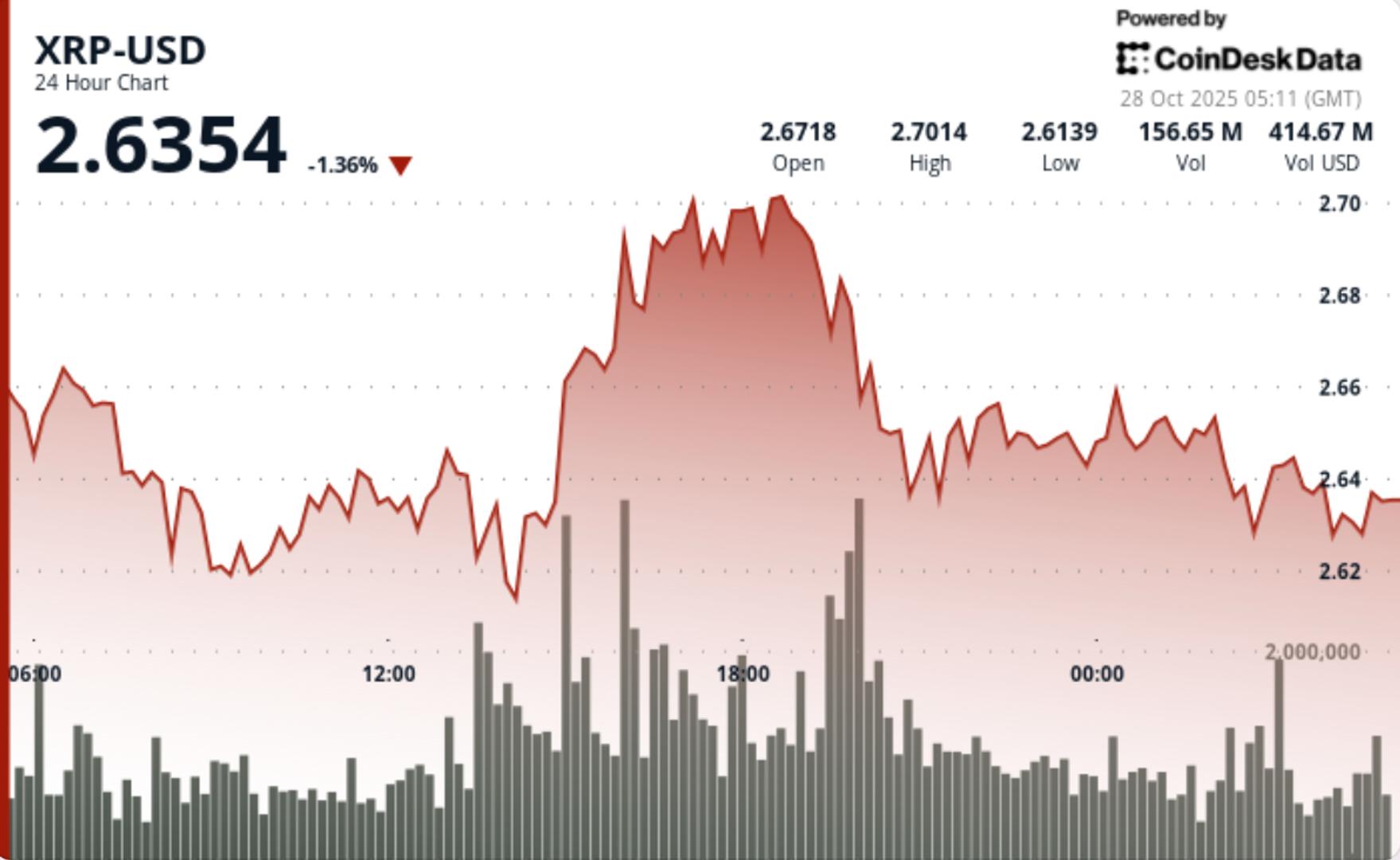

XRP Edges Higher to $2.63 as Volume Surges Signal Growing Trader Interest

PositiveCryptocurrency

XRP has seen a notable increase, reaching $2.63, driven by a surge in trading volume that indicates growing interest among traders. This uptick is significant as it reflects a positive sentiment in the cryptocurrency market, suggesting that more investors are looking to engage with XRP. As the market evolves, this could lead to further price movements and opportunities for traders.

— Curated by the World Pulse Now AI Editorial System