SEC Crypto Policy: Chairman Atkins Vague on Wallet Rules

NeutralCryptocurrency

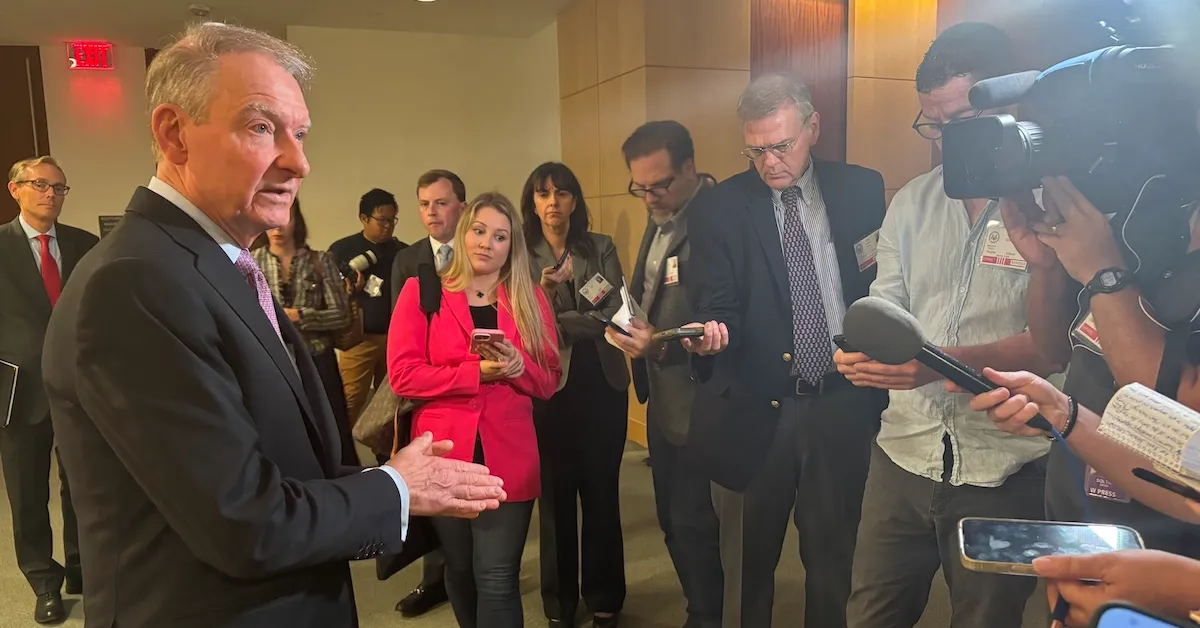

Chairman Paul Atkins of the SEC has recently commented on the agency's approach to cryptocurrency regulations, particularly regarding wallet rules. While he acknowledges the need for clarity in the securities market, his statements have been perceived as vague, leaving many in the crypto community uncertain about future regulations. This is significant as it highlights the ongoing challenges regulators face in adapting to the rapidly evolving digital asset landscape, which could impact investor confidence and market stability.

— Curated by the World Pulse Now AI Editorial System