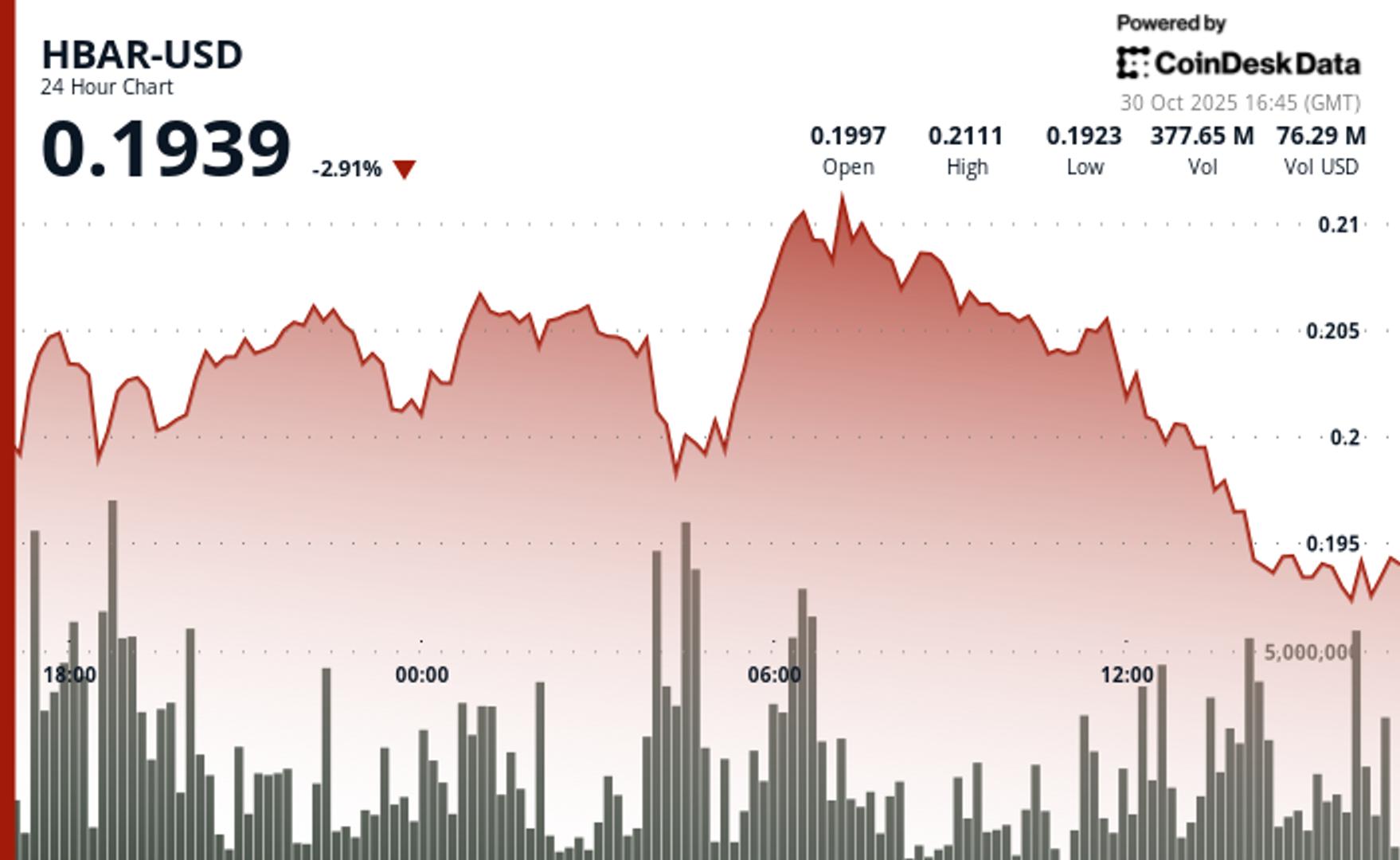

HBAR Declines 4% Following ETF Debut as Initial Euphoria Fades

NegativeCryptocurrency

HBAR has seen a 4% decline following the initial excitement surrounding its ETF debut. This drop highlights the volatility often seen in the cryptocurrency market, where initial euphoria can quickly fade. Investors are now reassessing their positions, which could signal a shift in market sentiment and impact future trading strategies.

— Curated by the World Pulse Now AI Editorial System