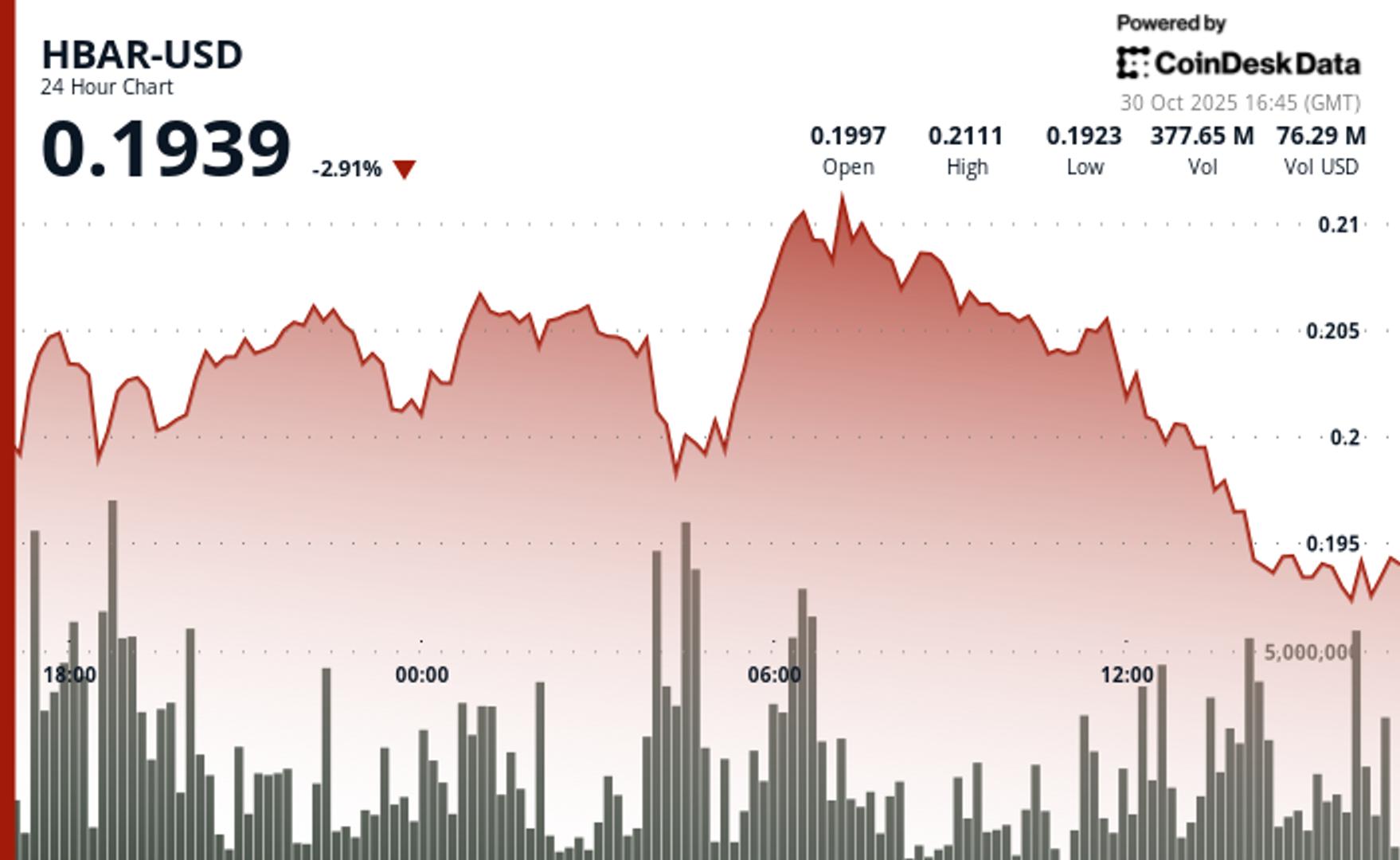

DOGE Slides 7.5% to $0.18, Triggering Technical Breakdown

NegativeCryptocurrency

Dogecoin has experienced a significant drop of 7.5%, falling to $0.18, which has triggered a technical breakdown in the market. This decline is concerning for investors as it reflects broader volatility in the cryptocurrency space, potentially impacting trading strategies and market confidence.

— Curated by the World Pulse Now AI Editorial System