Leaked code shows Metamask eyeing in-wallet perps via Hyperliquid

PositiveCryptocurrency

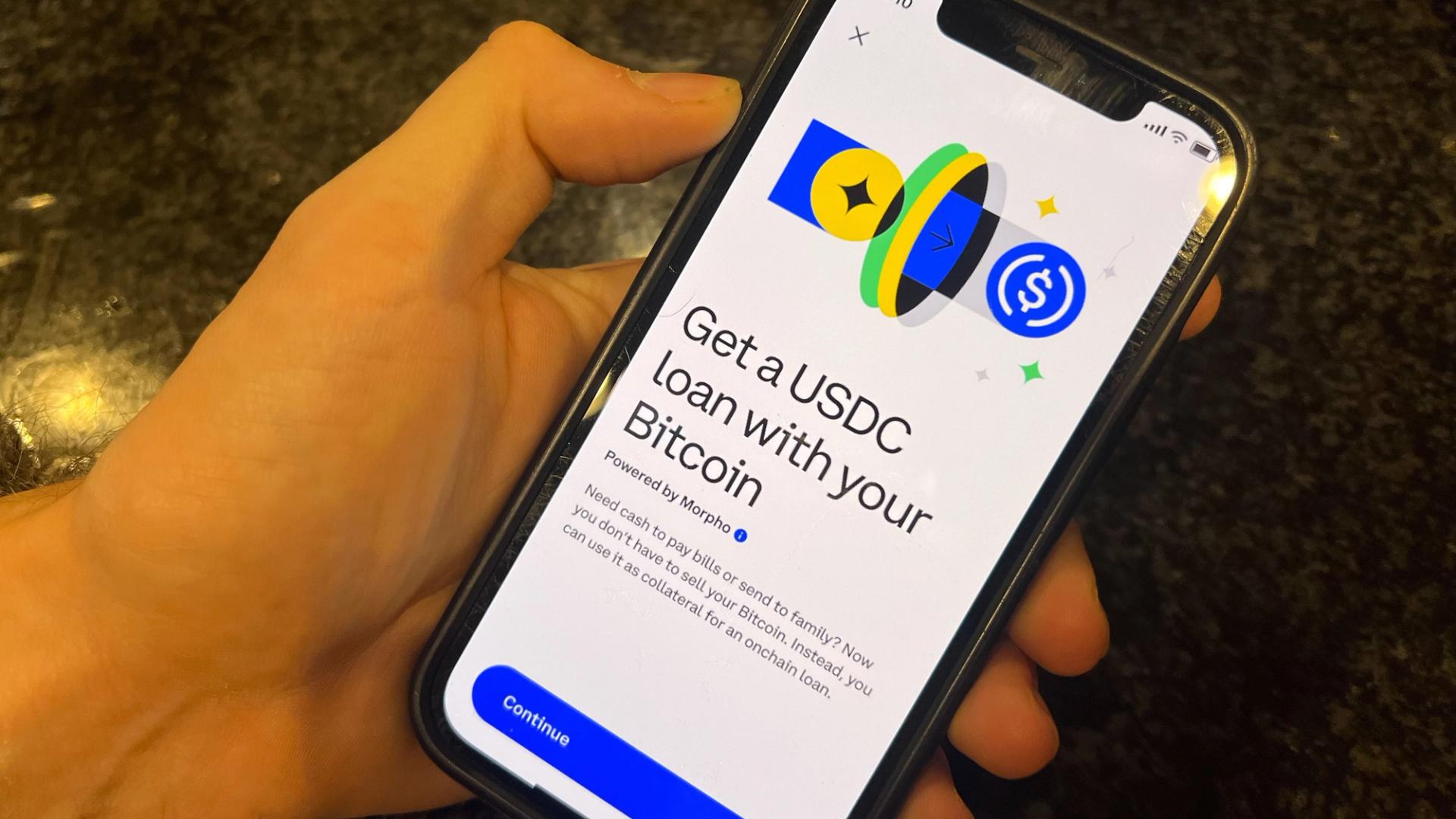

MetaMask is set to enhance its platform by integrating perpetual futures trading through Hyperliquid, as revealed by recent code leaks. This addition, which includes a dedicated 'Perps' tab and deposit options for USDC, indicates a shift towards offering leveraged trading features that are typically associated with centralized exchanges. This move could significantly broaden the trading capabilities for users, making MetaMask a more competitive player in the decentralized finance space.

— Curated by the World Pulse Now AI Editorial System