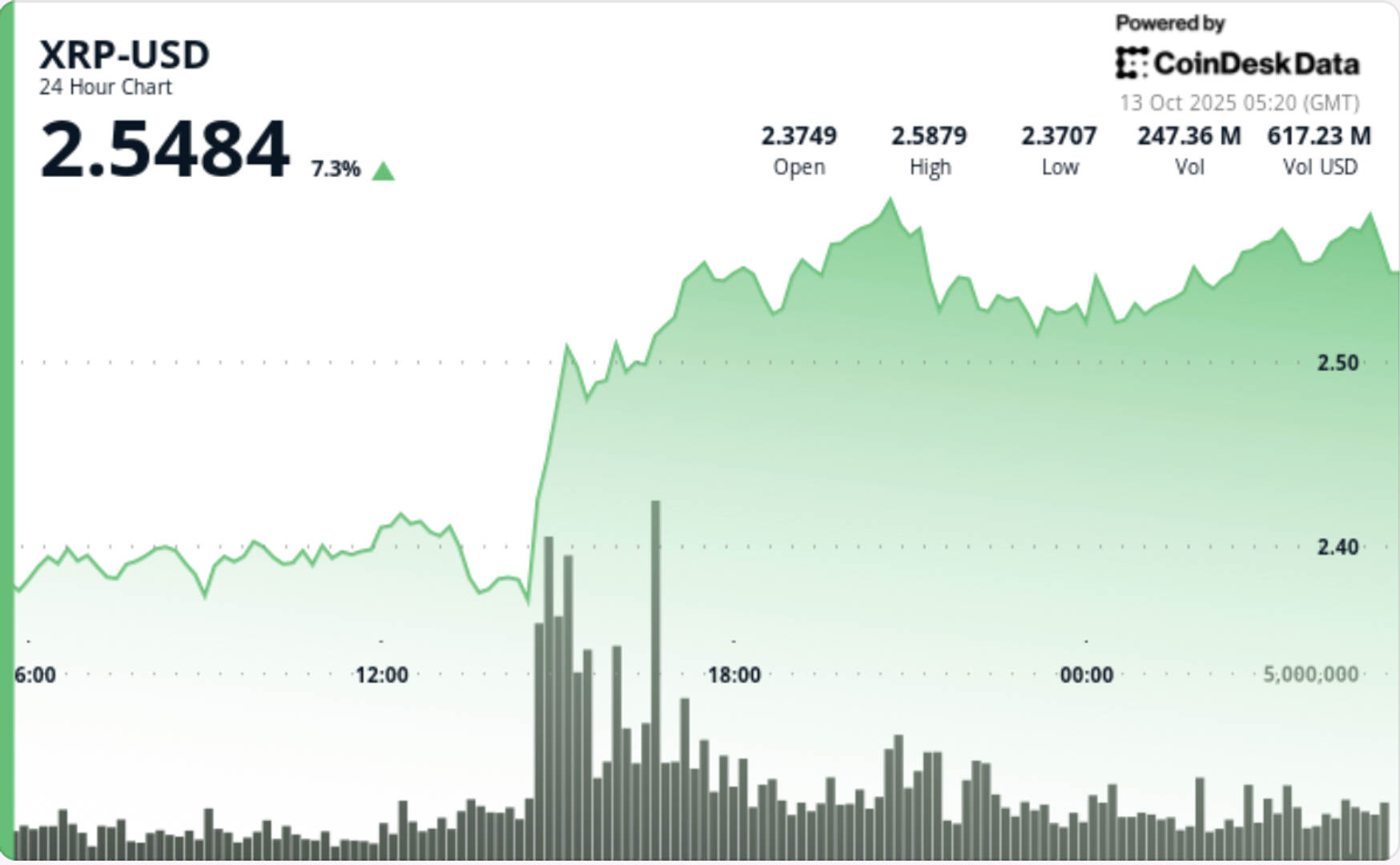

XRP Warning Signs Multiply: Indicators Hint at Roadblocks Ahead

NegativeCryptocurrency

Recent indicators suggest that XRP may face significant challenges ahead, raising concerns among investors. As the cryptocurrency market evolves, these warning signs could impact XRP's performance and investor confidence. Understanding these potential roadblocks is crucial for anyone involved in cryptocurrency trading, as they may influence market dynamics and investment strategies.

— Curated by the World Pulse Now AI Editorial System