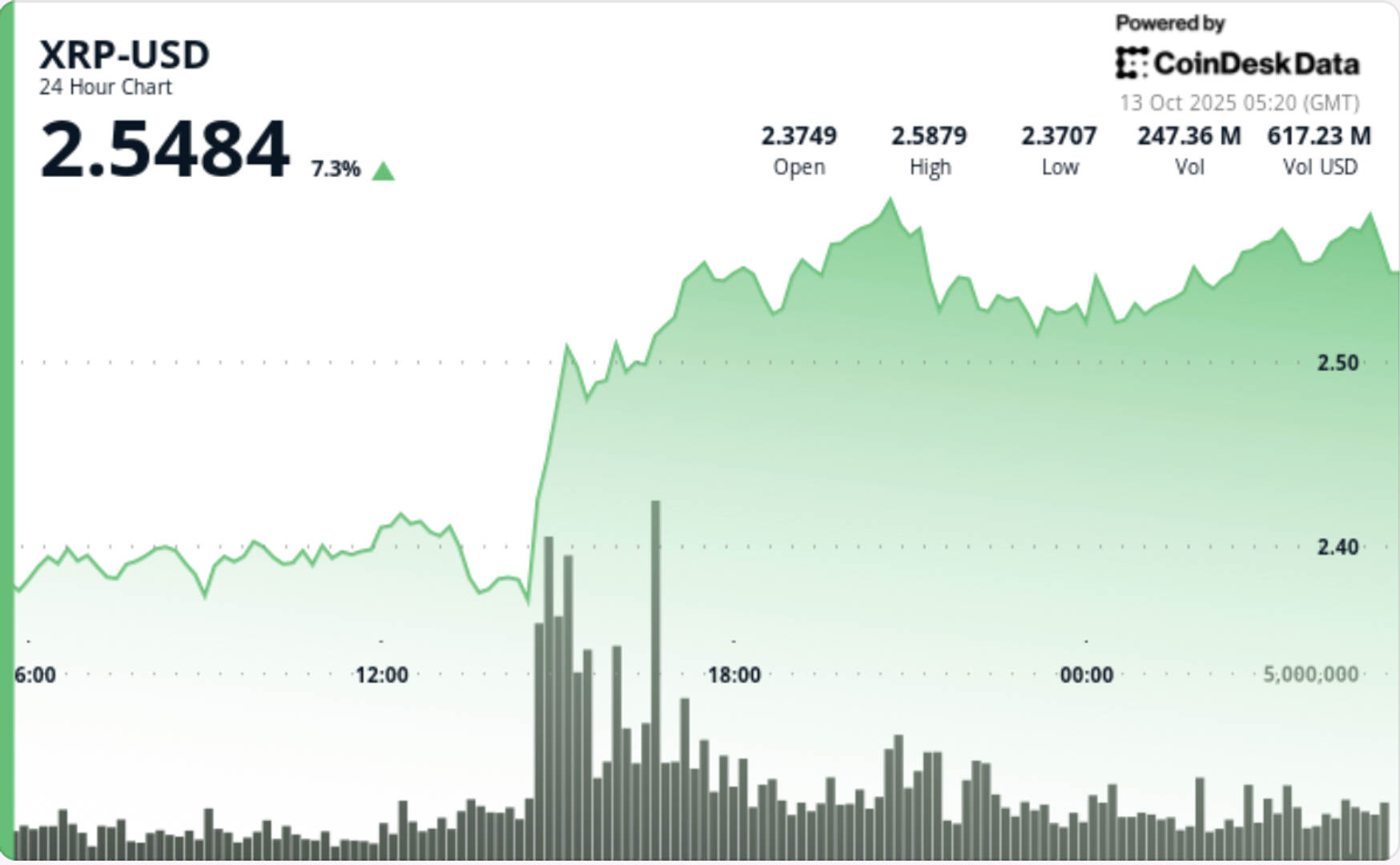

XRP Rebounds 8% as $30B Flows Back In After Trade-War Rout

PositiveCryptocurrency

XRP has seen a significant rebound of 8% as $30 billion flows back into the market following a tough period influenced by trade-war concerns. This surge indicates strong dip-buying activity among traders who are repositioning themselves ahead of upcoming macroeconomic news. This rebound is crucial as it reflects traders' confidence in the cryptocurrency market's resilience and potential for recovery.

— via World Pulse Now AI Editorial System