Bitcoin ‘bear market confirmed’: Watch these BTC price levels next

NegativeCryptocurrency

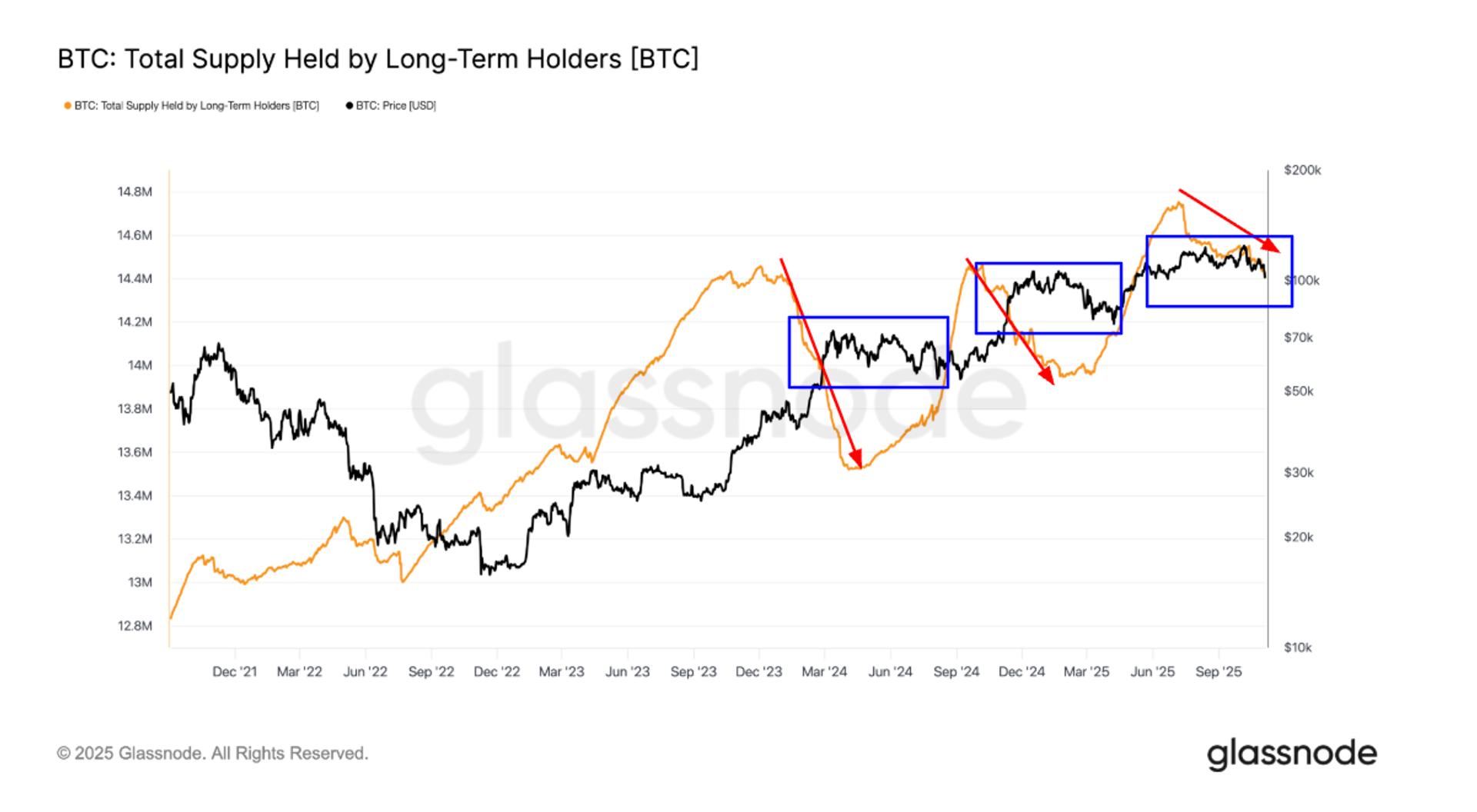

Bitcoin has officially entered a bear market, trading 20% below its all-time high of $126,000. This shift is significant as it reflects changing market conditions and investor sentiment, which could impact future trading strategies and investment decisions. Understanding these price levels and market indicators is crucial for anyone involved in cryptocurrency.

— Curated by the World Pulse Now AI Editorial System