Traders Angry as Trump Targets Crypto Industry to Foot Bill For New Whitehouse Ballroom Amid Market Crash

NegativeCryptocurrency

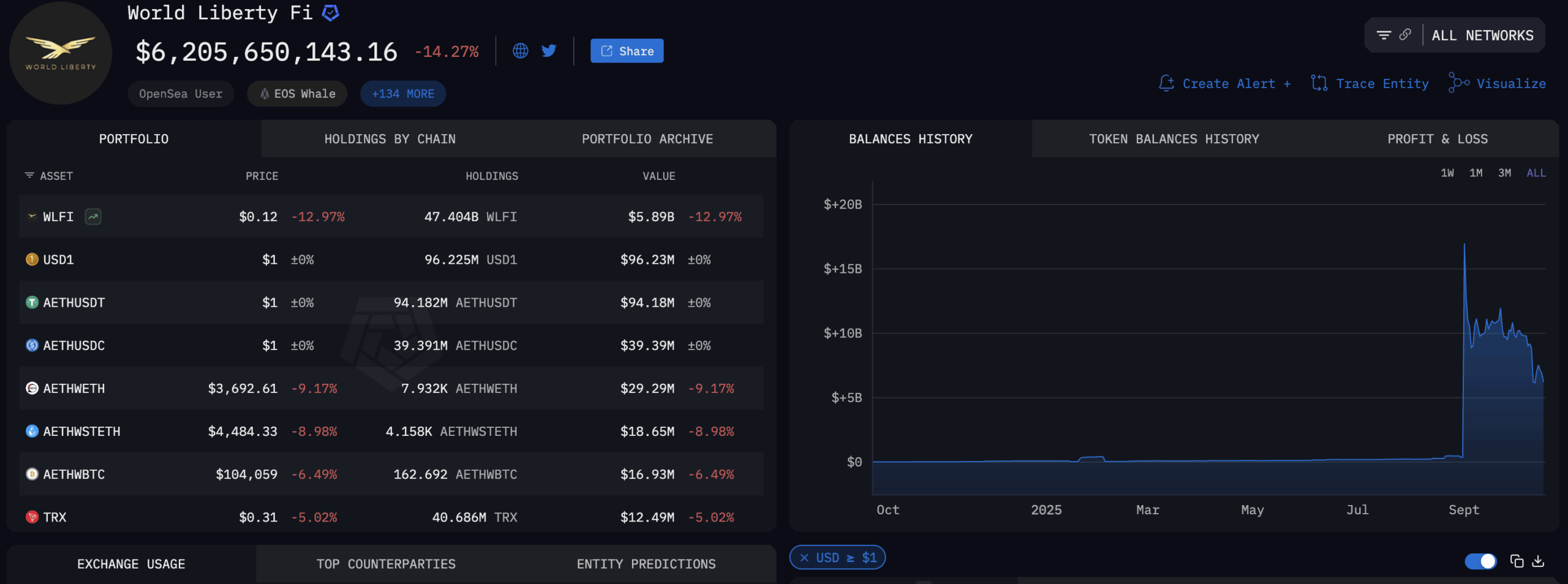

Traders are expressing their anger as President Donald Trump targets the crypto industry to fund a new $250 million ballroom at the White House. Despite recently announcing a personal gain of $1 billion from crypto ventures, Trump's dinner with executives from major firms like Gemini, Coinbase, and Ripple has raised eyebrows. This move comes at a time when the crypto market is already facing significant challenges, making it a contentious issue for those invested in the industry.

— Curated by the World Pulse Now AI Editorial System