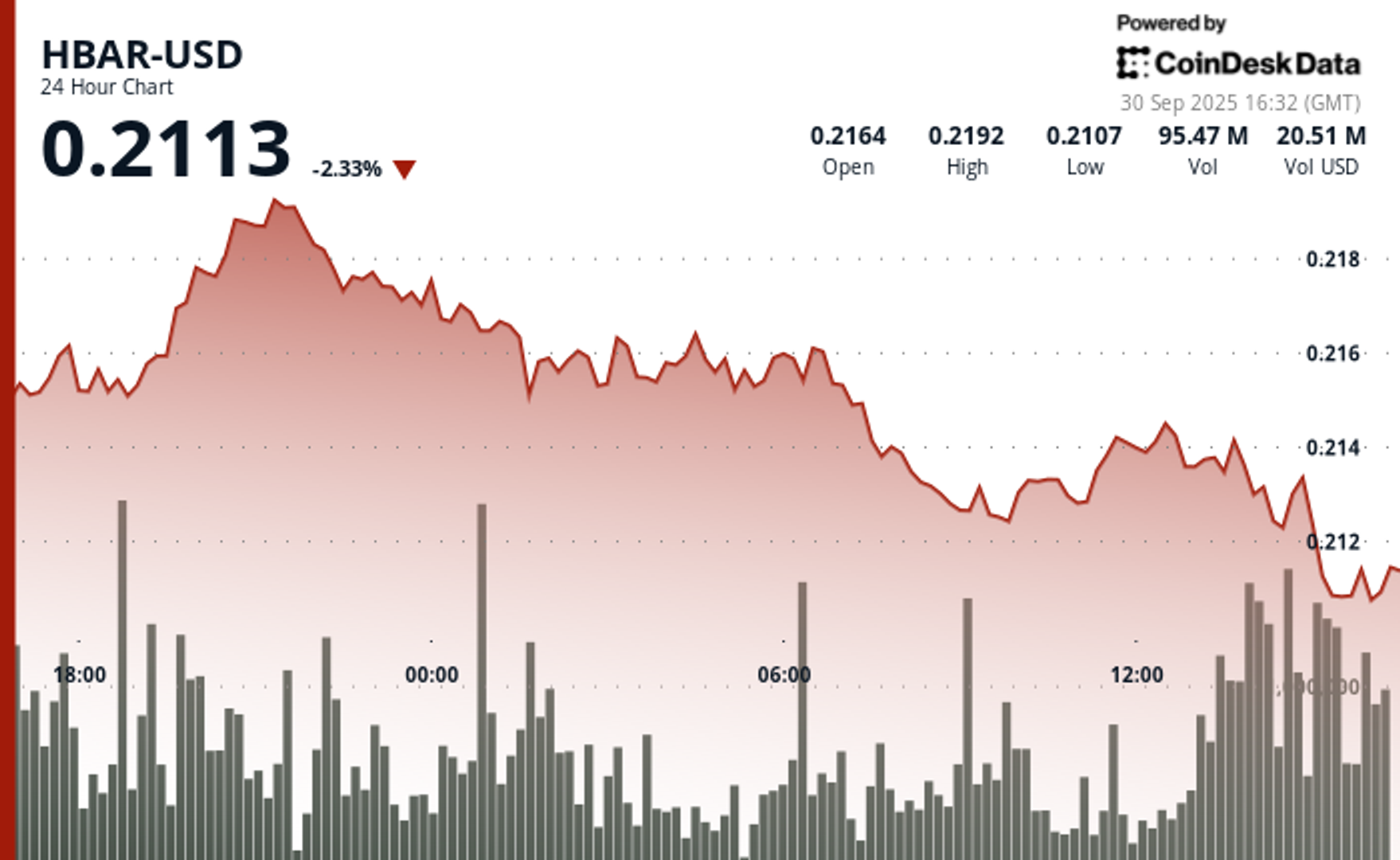

Hedera (HBAR) Slips 1.6% Daily but ETF Hopes and Swift Partnership Keep Uptober Rally in Play

PositiveCryptocurrency

Despite a slight decline of 1.6% in HBAR's value, the outlook for Hedera remains bright as optimism around ETFs grows. This is significant because it positions HBAR alongside major altcoins, attracting more attention and investment. Additionally, Hedera's collaboration with SWIFT and other financial giants indicates a strengthening of its market presence, which could lead to further advancements in the cryptocurrency space.

— Curated by the World Pulse Now AI Editorial System