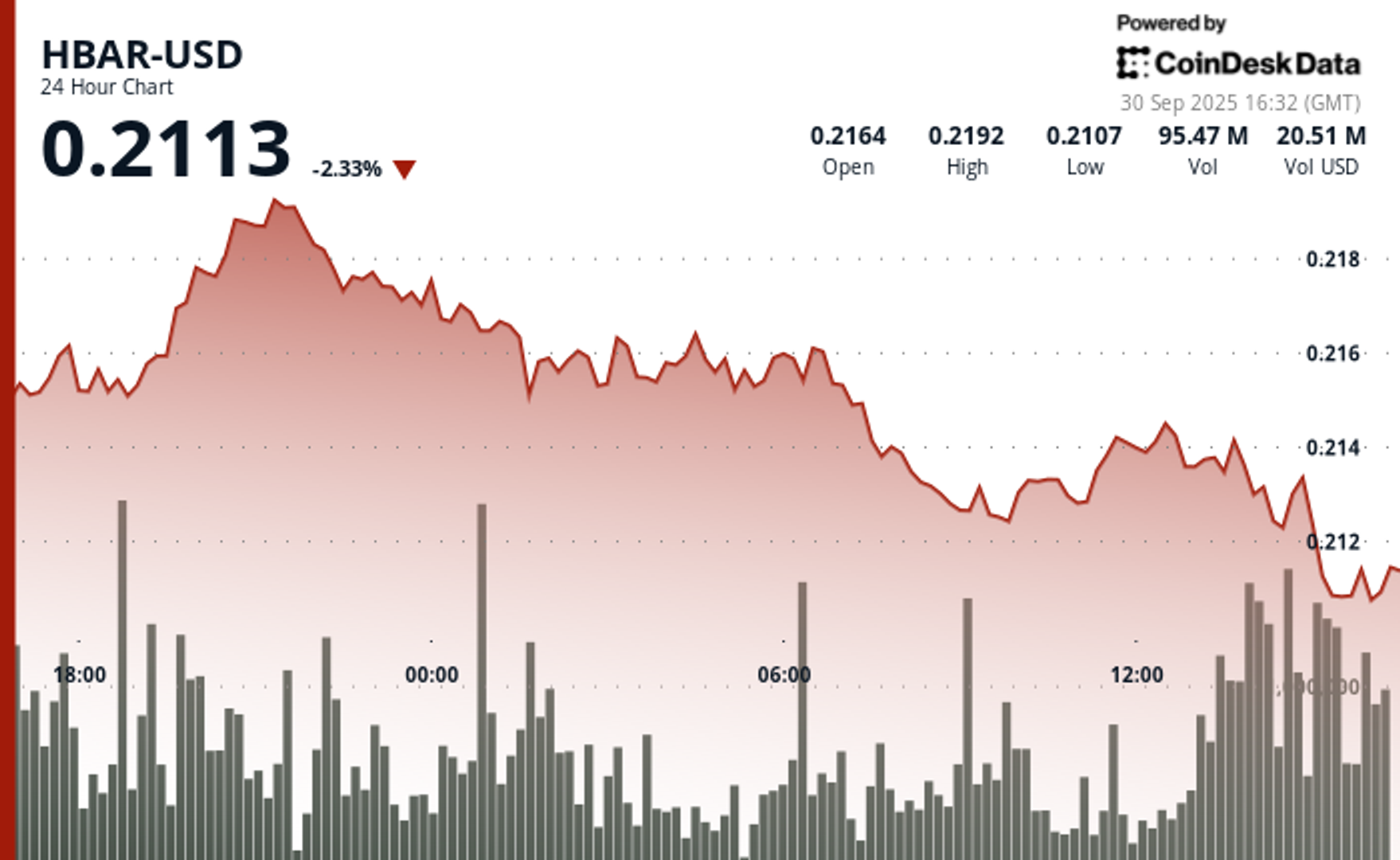

Institutional Selling Pushes HBAR Below Key Support

NegativeCryptocurrency

Hedera Hashgraph's token, HBAR, has fallen below a crucial support level due to increased institutional selling and ongoing regulatory uncertainty. With trading volumes hitting 55 million, corporate investors are reassessing their positions, which raises concerns about the token's stability and future prospects. This situation is significant as it reflects broader market trends and investor sentiment towards cryptocurrencies amidst regulatory scrutiny.

— Curated by the World Pulse Now AI Editorial System