Trump Tower moving on chain: How the President could make millions

PositiveCryptocurrency

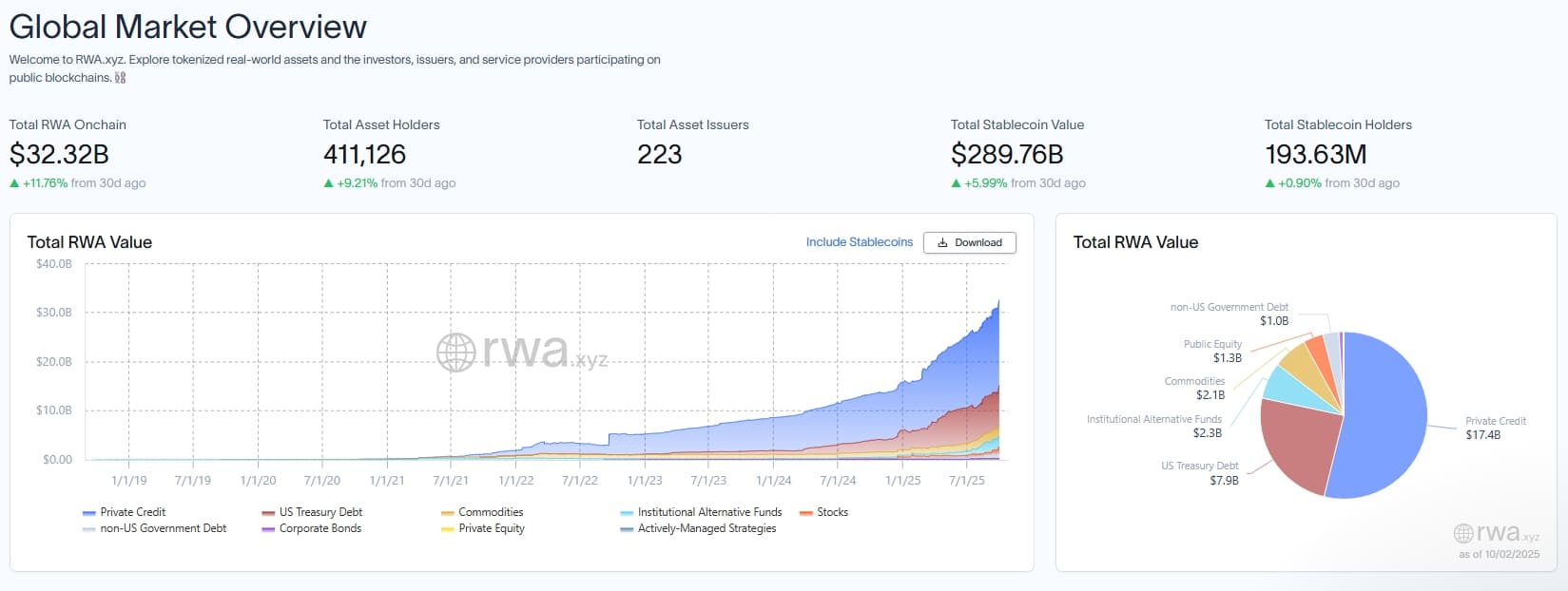

Donald Trump's venture into blockchain through World Liberty Financial is set to revolutionize real estate investment. By tokenizing parts of his multi-billion-dollar portfolio, Trump aims to make high-value properties accessible to everyday investors. This move not only showcases the potential of blockchain technology in democratizing investment opportunities but also highlights Trump's innovative approach to leveraging his brand in the digital age.

— Curated by the World Pulse Now AI Editorial System