$46B poured into stablecoins last quarter: Here’s who took the lead

PositiveCryptocurrency

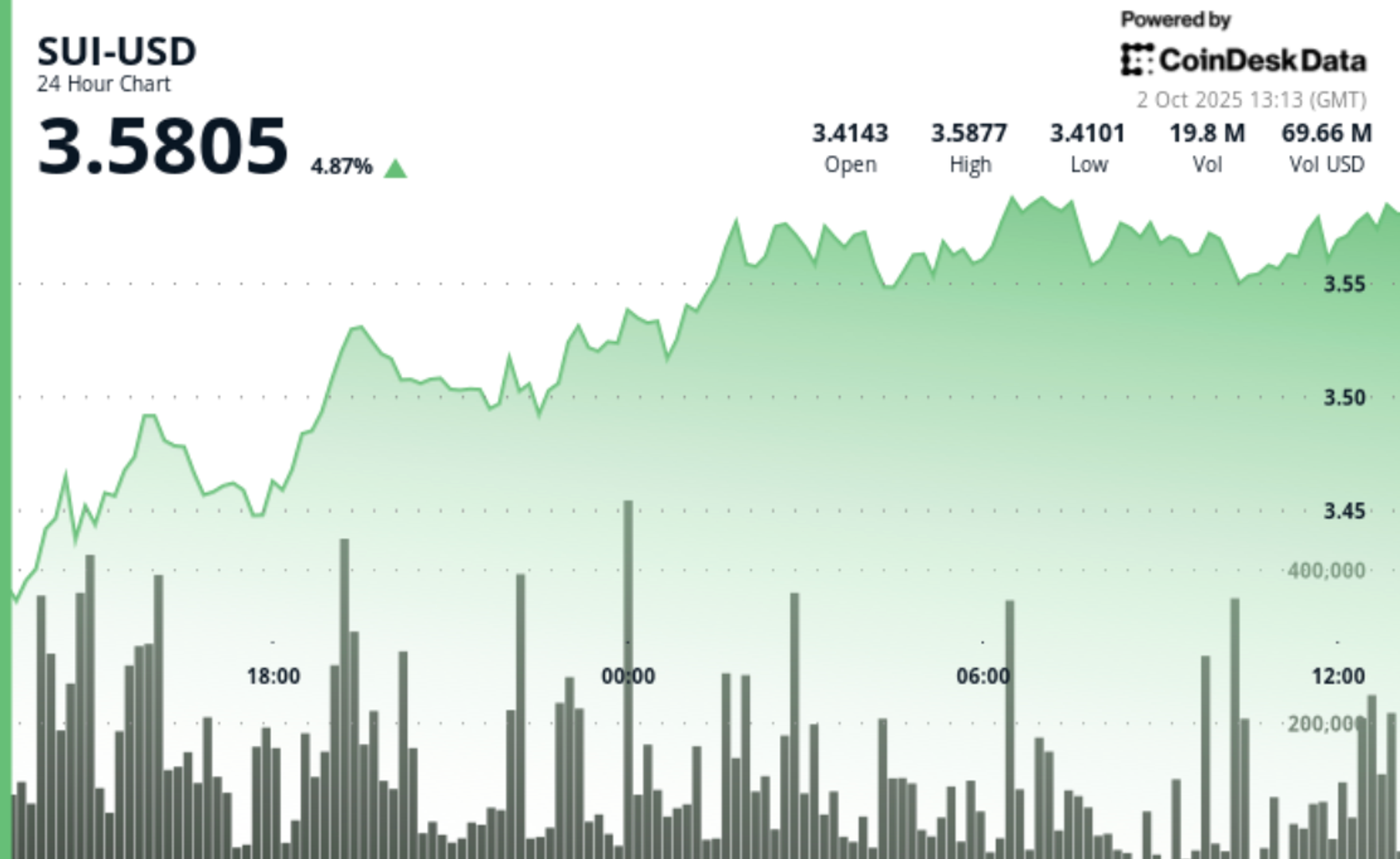

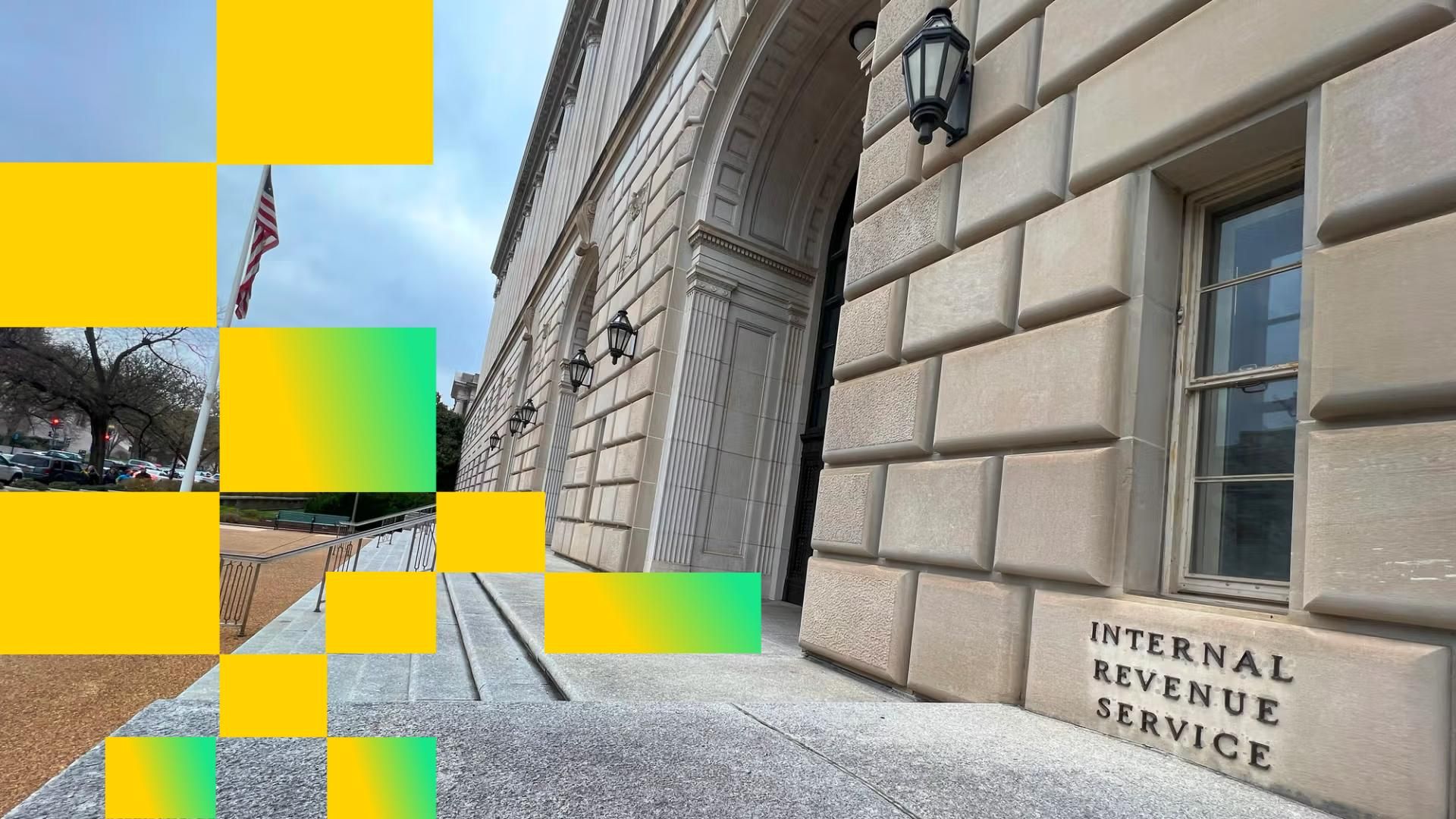

In the third quarter, stablecoins saw a remarkable increase of $46 billion in net supply, with USDT, USDC, and USDe leading the charge. This surge highlights the growing confidence in stablecoins as a reliable digital asset, attracting significant investments and reshaping the cryptocurrency landscape. Understanding where these funds are flowing and the implications for the market is crucial for investors and enthusiasts alike.

— Curated by the World Pulse Now AI Editorial System