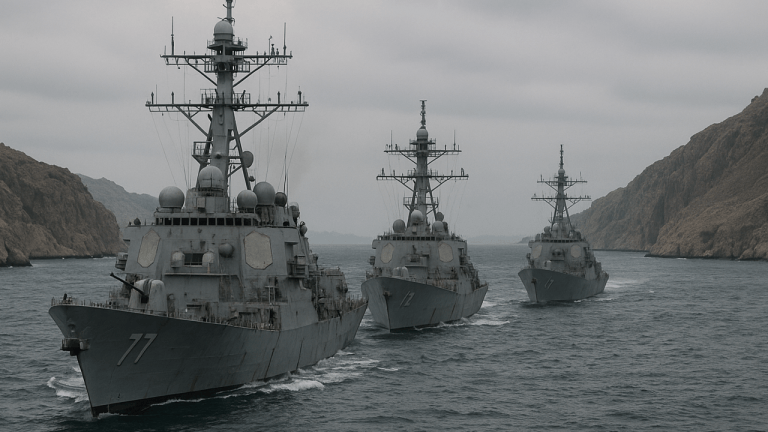

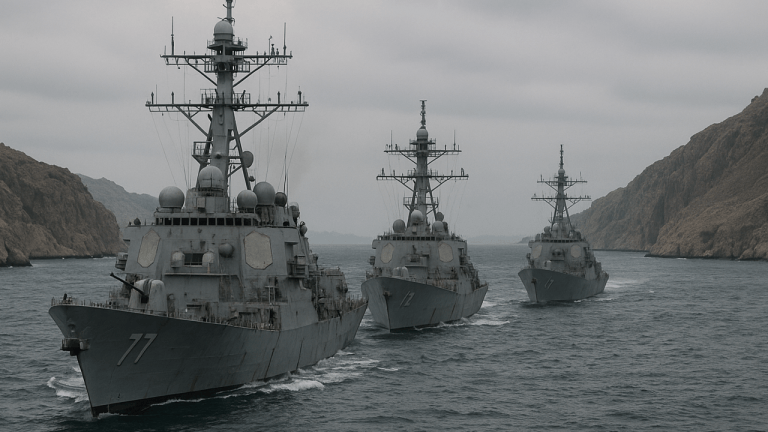

$150 Oil on the Table: Goldman Analysts Warn as Iran Threatens Strait Shutdown

XRP gains momentum as SEC signals boost ETF odds to 95%, while Ripple's legal team reassures against seizure fears, and the token rebounds with bullish patterns.

All major sources, one page

Feel the mood behind headlines

Know what’s trending, globally

Get summaries. Save time

7,037

120

211

3 hours ago

Get instant summaries, explore trending stories, and dive deeper into the headlines — all in one sleek, noise-free mobile experience.

Stay sharp in 60 seconds. Get concise summaries of today’s biggest stories — markets, tech, sports, and more

All major sources, one page

Feel the mood behind headlines

Know what’s trending, globally

Get summaries. Save time

7,037

120

211

3 hours ago

Get instant summaries, explore trending stories, and dive deeper into the headlines — all in one sleek, noise-free mobile experience.

Stay sharp in 60 seconds. Get concise summaries of today’s biggest stories — markets, tech, sports, and more