See what’s trending right now

XRPin Cryptocurrency

4 hours agoRipple's RLUSD stablecoin hits $500M with BNY Mellon as custodian, while XRP gains political attention by making Trump's crypto top 5 and a mysterious holder controls 2% of all XRP.

Show me

Cryptocurrency

Ripple Taps BNY Mellon to Custody Stablecoin Reserves as RLUSD Surpasses $500M

positiveCryptocurrency

Ripple has partnered with banking giant BNY Mellon to safeguard the reserves for its stablecoin, RLUSD, which just crossed the $500 million mark. This move signals growing trust in Ripple’s stablecoin project and adds a heavyweight custodian to its financial infrastructure.

Editor’s Note: Stablecoins need rock-solid backing to maintain their value, and teaming up with a legacy institution like BNY Mellon gives RLUSD credibility. For crypto watchers, this is another sign that big finance and blockchain are getting cozier—which could mean more stability (and maybe more adoption) ahead.

XRP Makes Trump’s Unspoken Crypto Top 5—What You Need To Know

neutralCryptocurrency

Donald Trump’s media company, TMTG, just filed paperwork with the SEC for a new crypto ETF called the "Truth Social Crypto Blue Chip ETF." The fund would mainly hold Bitcoin (70%) and Ethereum (15%), with smaller slices of Solana, Cronos, and—surprisingly—XRP (2%). Despite rumors floating around earlier, the official filing only happened on July 8.

Editor’s Note: Love him or hate him, Trump’s team dipping into crypto is a big deal—especially with XRP in the mix, given its legal gray area. This could signal more mainstream political players warming up to crypto, or just a savvy (or chaotic) play for attention. Either way, it’s another sign that crypto’s getting harder for regulators and traditional finance to ignore.

2% Of All XRP Is In His Hands — But Who Is He?

neutralCryptocurrency

A mysterious yet influential figure in the crypto world, Arthur Britto—co-founder of Ripple Labs and a key architect behind XRP—just broke a 14-year public silence with a single emoji on X (formerly Twitter). Despite staying out of the spotlight, Britto holds a staggering 2% of all XRP, making him a major player in the asset's ecosystem. His sudden reappearance has set off speculation among investors and developers about what it could mean for XRP's future.

Editor’s Note: Britto's cryptic return matters because he’s not just any crypto figure—he helped create XRP and still holds a massive chunk of it. His silence over the years has only fueled curiosity, so even a tiny signal from him could ripple through the market (pun intended). Whether this leads to new developments or just more speculation, it’s a reminder of how much influence early crypto pioneers still wield.

XRP Price Regains Traction — Is a Powerful Upside Break Brewing?

positiveCryptocurrency

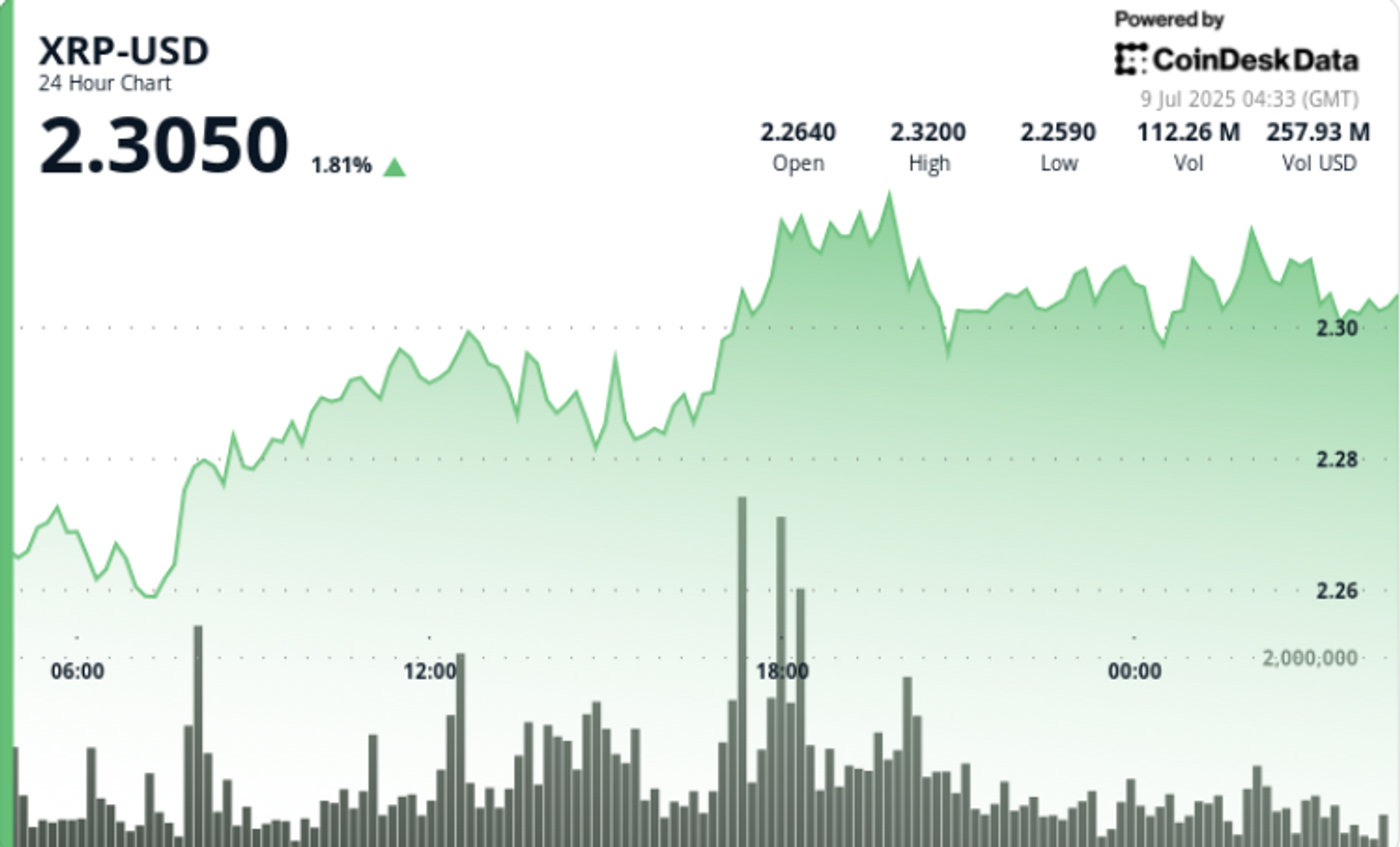

XRP is showing signs of a comeback, climbing above $2.30 and hinting at a potential breakout. With a bullish trend forming and solid support around $2.28, traders are eyeing whether it can push past the $2.32 resistance. If it holds above $2.25, another surge might be on the horizon.

Editor’s Note: For crypto watchers, XRP's rebound is worth tracking—it could signal renewed momentum for the token after a rocky stretch. If it breaks higher, it might pull in more traders betting on a sustained rally. But as always in crypto, nothing’s guaranteed—so buckle up.

Key Market Dynamic Keeps Bitcoin, XRP Anchored to $110K and $2.3 as Ether Looks Prone to Volatility

neutralCryptocurrency

Bitcoin and XRP are holding steady around $110,000 and $2.30 respectively, thanks to a key market force—likely institutional demand or a technical support level. Meanwhile, Ether is showing signs of volatility, possibly due to shifting investor sentiment or upcoming network updates.

Editor’s Note: If you're watching crypto markets, this is a heads-up that Bitcoin and XRP might be in a stable phase (for now), while Ether could be in for some swings. Stability in big players like Bitcoin often signals broader market confidence, but Ether's volatility could mean traders are bracing for news or just reacting to short-term trends. Either way, it’s a reminder that crypto never stays quiet for long.

XRP Clears $2.28 on Breakout Volume, Eyes $2.30 on Ripple's Banking Charter Push

positiveCryptocurrency

XRP, the cryptocurrency linked to Ripple, has surged past $2.28 with strong trading volume, flirting with the $2.30 mark. The rally comes amid speculation that Ripple might secure a banking charter, which could boost its legitimacy and utility in the financial sector.

Editor’s Note: If Ripple gets that banking charter, it could be a game-changer—making XRP more than just another crypto but a real player in traditional finance. That’s why traders are piling in, betting this isn’t just a short-term spike. For crypto watchers, it’s a sign that the lines between digital assets and old-school banking are blurring faster than ever.

XRP Price Closes Highest Quarterly Candle In History

positiveCryptocurrency

XRP just hit a major milestone by closing its highest quarterly price candle ever, marking a significant moment in its often sluggish, consolidation-heavy history. This isn't just a blip—it suggests XRP might finally be shaking off its reputation for slow movement and solidifying its long-term potential.

Editor’s Note: For XRP holders, this is a big deal. The token has spent years stuck in sideways trading, frustrating investors who expected faster gains. A record-breaking quarterly close could signal renewed confidence—or at least prove XRP isn’t dead in the water. Whether this momentum holds is the real question, but for now, it’s a win worth noting.

It’s ‘Make Or Break’ Time For XRP As Fib Extension Points To $5.30 Top

positiveCryptocurrency

A crypto analyst known as Guy is sounding the alarm for XRP, calling this a pivotal moment—either it breaks out of its current slump or risks stagnation. According to his analysis, if XRP surges, it could skyrocket to a record high of $5.30. The market’s watching closely to see if this prediction holds water or if it’s just another crypto hype cycle.

Will XRP price benefit from a short squeeze in July?

neutralCryptocurrency

XRP's price is showing some interesting movement, with two chart patterns hinting at a possible short squeeze in July. For those not glued to crypto jargon, a short squeeze happens when traders betting against a token (shorting) are forced to buy it back as prices rise, driving the price up even more. XRP was trading at $2.30 on June 8, up 20% from its June low—so there's some momentum building. Whether this turns into a bigger rally depends on how the market reacts.

Why World Pulse Now?

Global Coverage

All major sources, one page

Emotional Lens

Feel the mood behind headlines

Trending Topics

Know what’s trending, globally

Read Less, Know More

Get summaries. Save time

Stay informed, save time

Learn moreLive Stats

Articles Processed

8,259

Trending Topics

125

Sources Monitored

211

Last Updated

2 minutes ago

Live data processing

How it works1-Minute Daily Briefing

Stay sharp in 60 seconds. Get concise summaries of today’s biggest stories — markets, tech, sports, and more

Why World Pulse Now?

Global Coverage

All major sources, one page

Emotional Lens

Feel the mood behind headlines

Trending Topics

Know what’s trending, globally

Read Less, Know More

Get summaries. Save time

Stay informed, save time

Learn moreLive Stats

Articles Processed

8,259

Trending Topics

125

Sources Monitored

211

Last Updated

2 minutes ago

Live data processing

How it works1-Minute Daily Briefing

Stay sharp in 60 seconds. Get concise summaries of today’s biggest stories — markets, tech, sports, and more