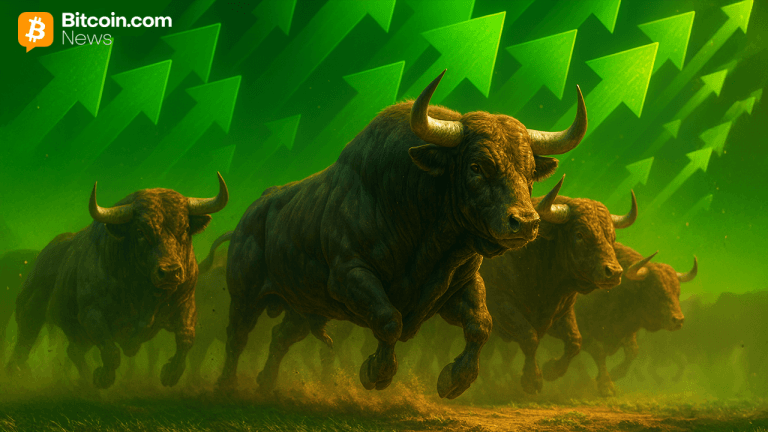

Bitcoin tops $120K, triggering $400M in liquidations

PositiveCryptocurrency

Bitcoin has surged past $120,000, marking its highest point since August and leading to $400 million in liquidations. This significant price movement is attracting attention as traders anticipate a strong performance in October, which historically has been a favorable month for the cryptocurrency. The rise not only reflects growing confidence in Bitcoin but also highlights the volatility and potential for profit in the crypto market.

— Curated by the World Pulse Now AI Editorial System