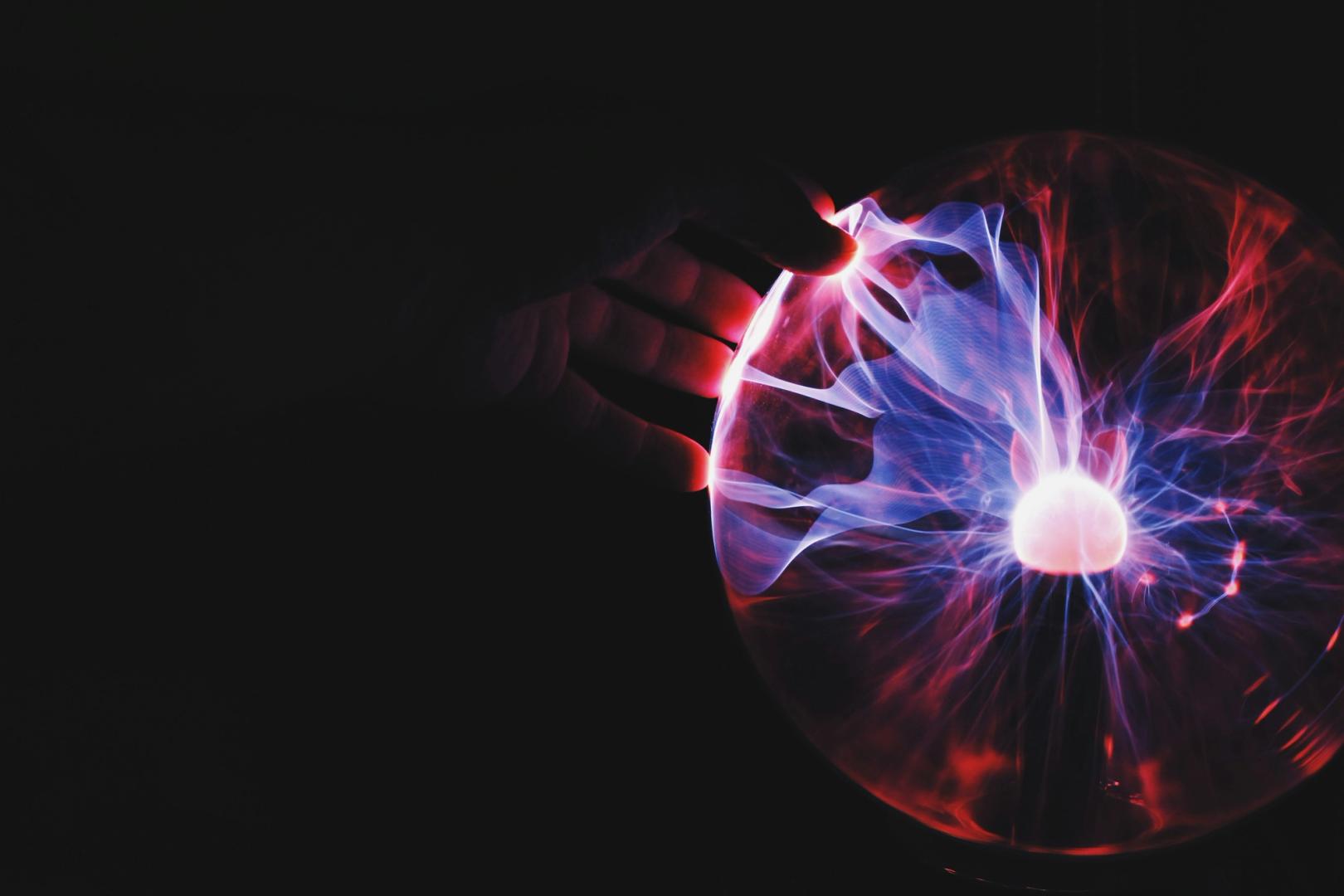

Plasma to Launch Mainnet Beta Blockchain for Stablecoins Next Week

PositiveCryptocurrency

Plasma is set to launch its mainnet beta blockchain for stablecoins next week, boasting over $2 billion in liquidity. This is significant as it could enhance the stability and usability of cryptocurrencies, attracting more users and investors to the blockchain space.

— Curated by the World Pulse Now AI Editorial System