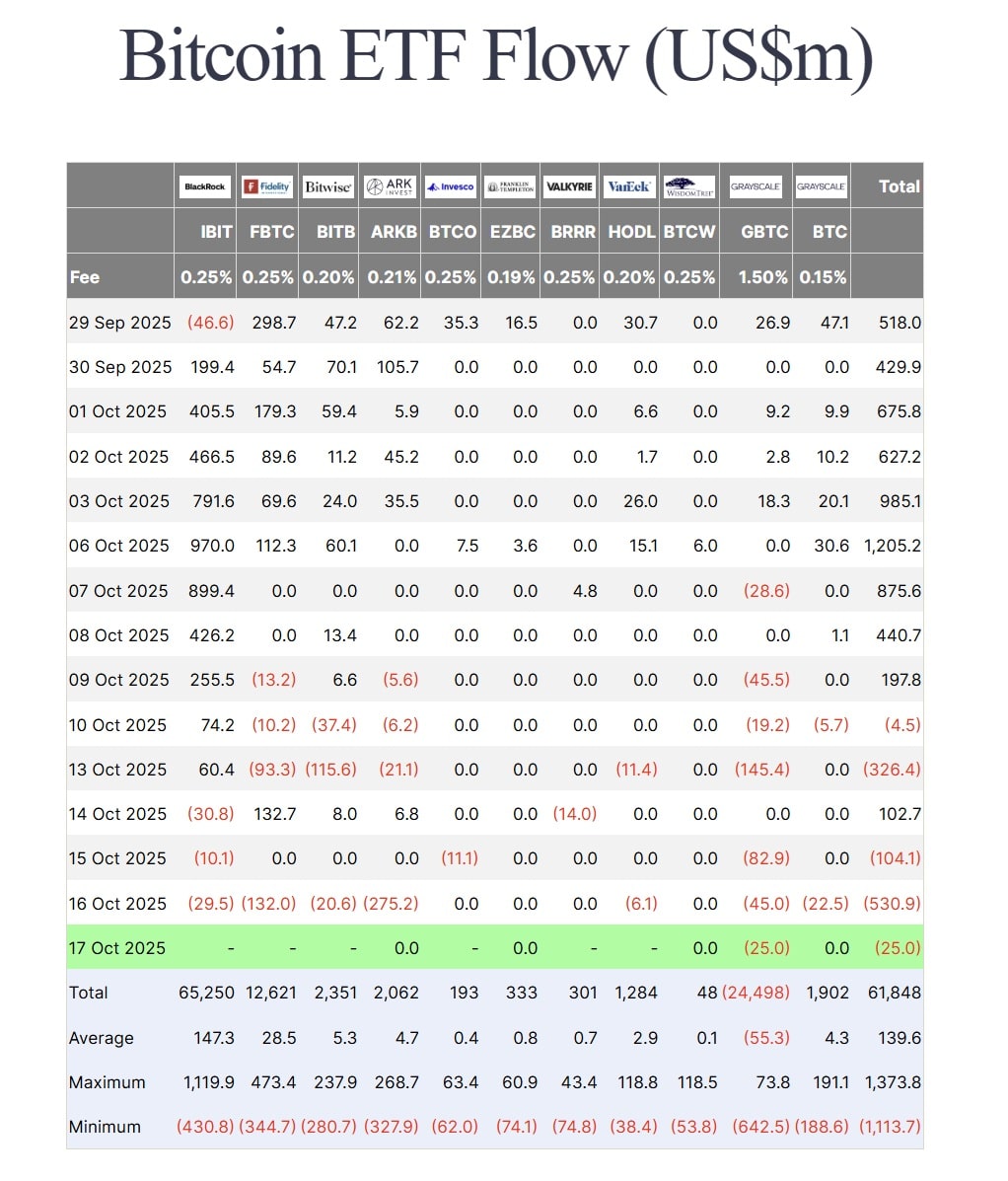

ARK 21Shares Bitcoin ETF Sees Heavy $275M Outflows in One Day

NegativeCryptocurrency

The ARK 21Shares Bitcoin ETF experienced a significant outflow of $275.2 million in just one day, marking its largest daily drop since August. This alarming trend has raised concerns among analysts about the waning institutional confidence in cryptocurrency ETFs. Such a substantial exit could indicate a shift in market sentiment, making it crucial for investors to monitor the situation closely.

— Curated by the World Pulse Now AI Editorial System