Crypto Tanks After Fed Cut: Santiment Breaks Down The Trap

NeutralCryptocurrency

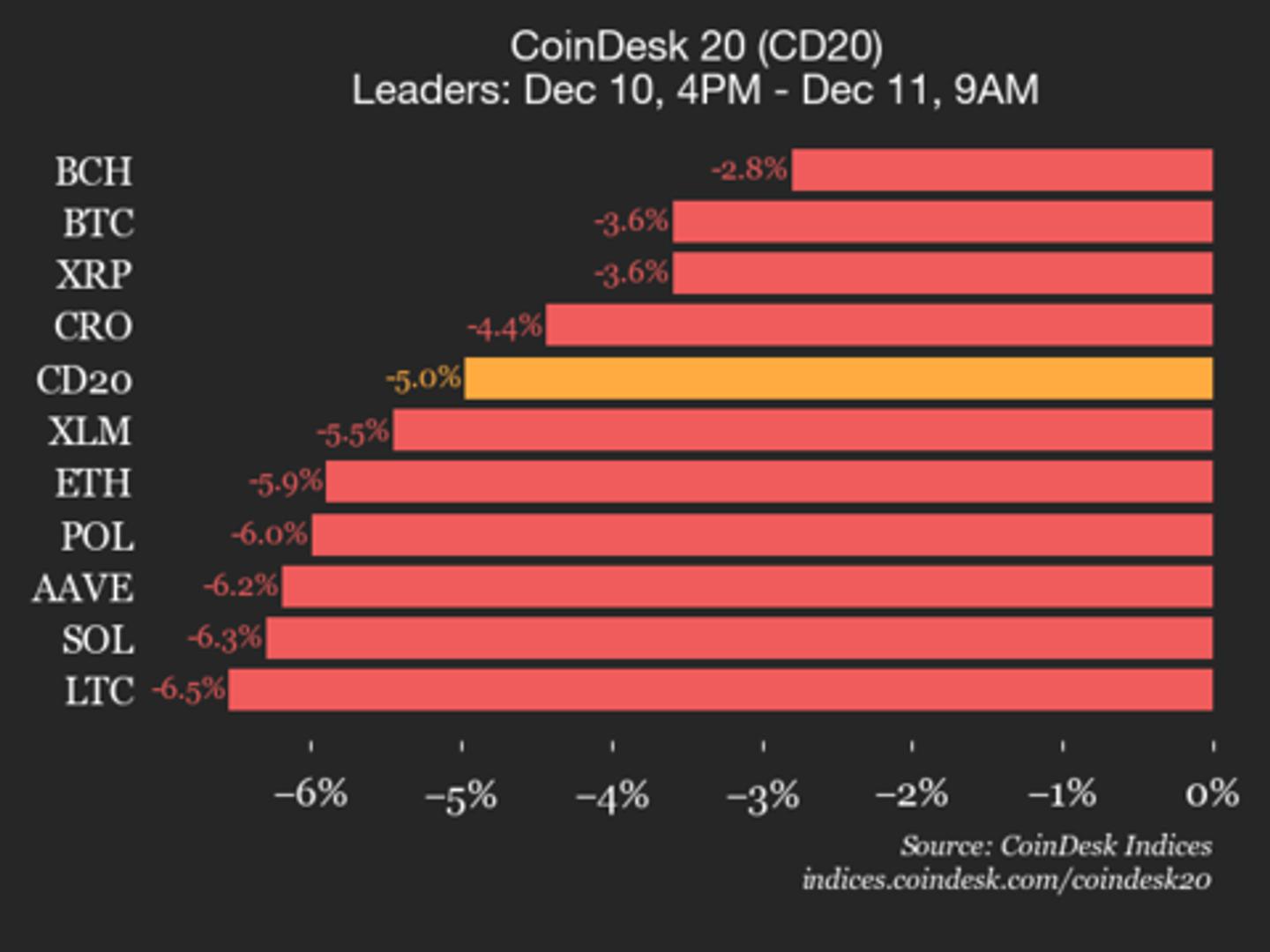

- The cryptocurrency market experienced a significant downturn following the Federal Reserve's third consecutive 25 basis point interest rate cut, which was anticipated by many. Despite initial price surges for Bitcoin, Ether, XRP, and Solana, the momentum quickly reversed, leading to notable declines in their values. Bitcoin fell over 5%, while Ether dropped more than 8.5% at one point.

- This development is crucial as it highlights the contrasting reactions between retail investors and larger market players, with retail viewing the rate cut as a positive signal while whales capitalized on the situation as exit liquidity. The Fed's decision reflects ongoing economic conditions, including moderate growth and inflation concerns.

- The market's volatility underscores a broader trend of investor sentiment shifting, particularly as Bitcoin and Ether faced significant outflows, while Solana and XRP demonstrated resilience with positive inflows. Additionally, the accumulation of Bitcoin off exchanges indicates a potential long-term holding strategy among investors, suggesting a complex interplay between short-term trading behaviors and long-term investment strategies.

— via World Pulse Now AI Editorial System