Crypto Markets Today: BTC Wilts After First Red October Since 2018

NegativeCryptocurrency

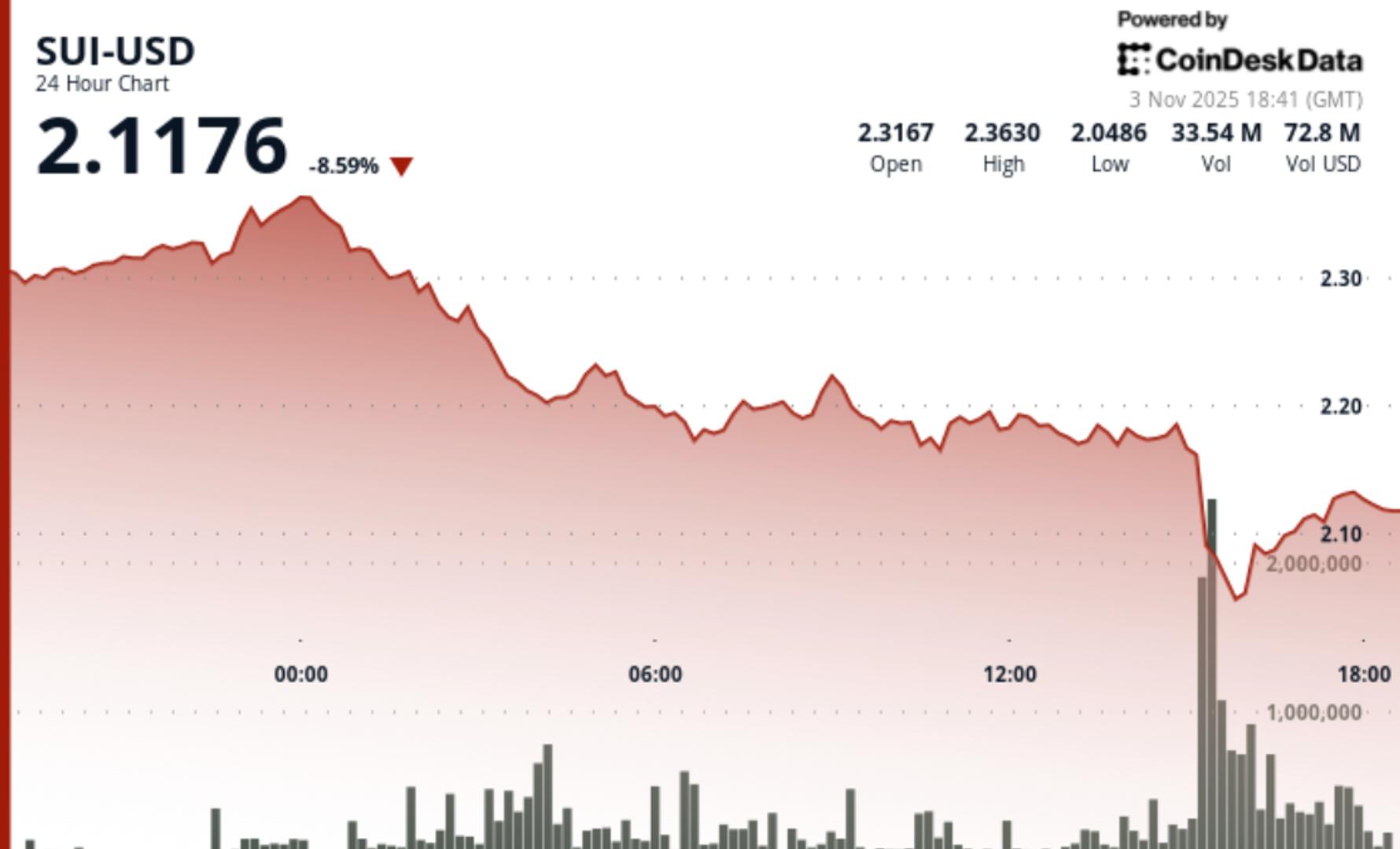

Today, the cryptocurrency markets are experiencing a downturn, with Bitcoin showing its first significant decline in October since 2018. This shift is noteworthy as it reflects broader market trends and investor sentiment, raising concerns about the stability of digital currencies. Understanding these fluctuations is crucial for investors and enthusiasts alike, as they navigate the volatile landscape of cryptocurrencies.

— Curated by the World Pulse Now AI Editorial System