What Next for DOGE Price as Grayscale's GDOG ETF Debuts?

NeutralCryptocurrency

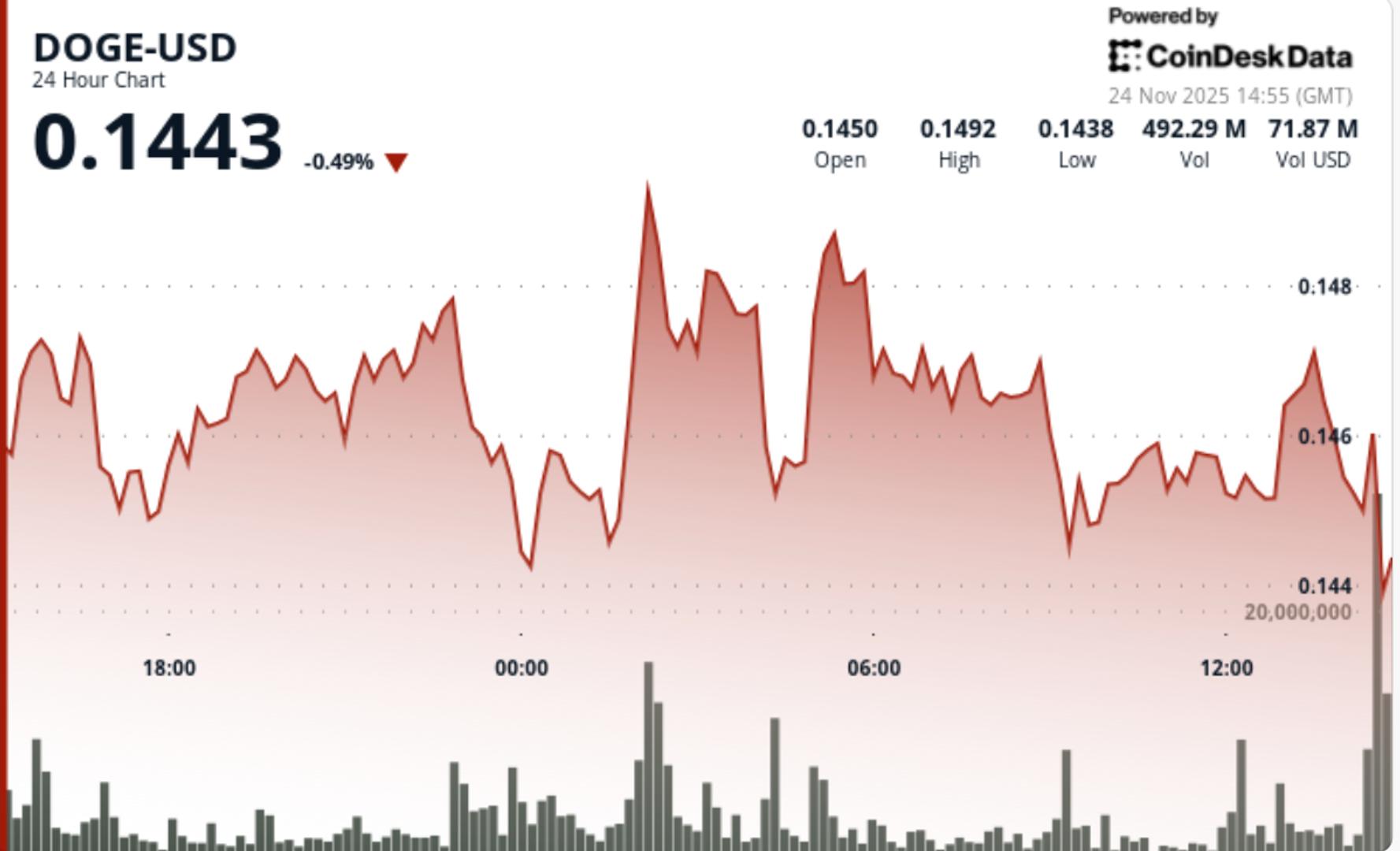

- Grayscale's GDOG ETF is set to debut on November 24, 2025, amidst a challenging market for Dogecoin (DOGE), which is currently facing significant resistance at the $0.1495 level and short-term support at $0.144. This launch marks a pivotal moment for DOGE as it seeks to establish itself within the institutional investment landscape.

- The introduction of the GDOG ETF is crucial for Grayscale, as it represents the first U.S. spot ETF for Dogecoin, potentially enhancing the cryptocurrency's legitimacy and attracting institutional investors. This could lead to increased trading volume and price stabilization for DOGE.

- The upcoming ETF launch occurs against a backdrop of fluctuating trader sentiment and bearish trends in the cryptocurrency market, with DOGE experiencing a decline in price and technical indicators suggesting ongoing weakness. This situation highlights the broader volatility in the crypto space, where new financial products like ETFs are being introduced amid concerns over market stability.

— via World Pulse Now AI Editorial System