XRP price risks 25% downside after confirming bearish pattern amid whale selloffs

NegativeCryptocurrency

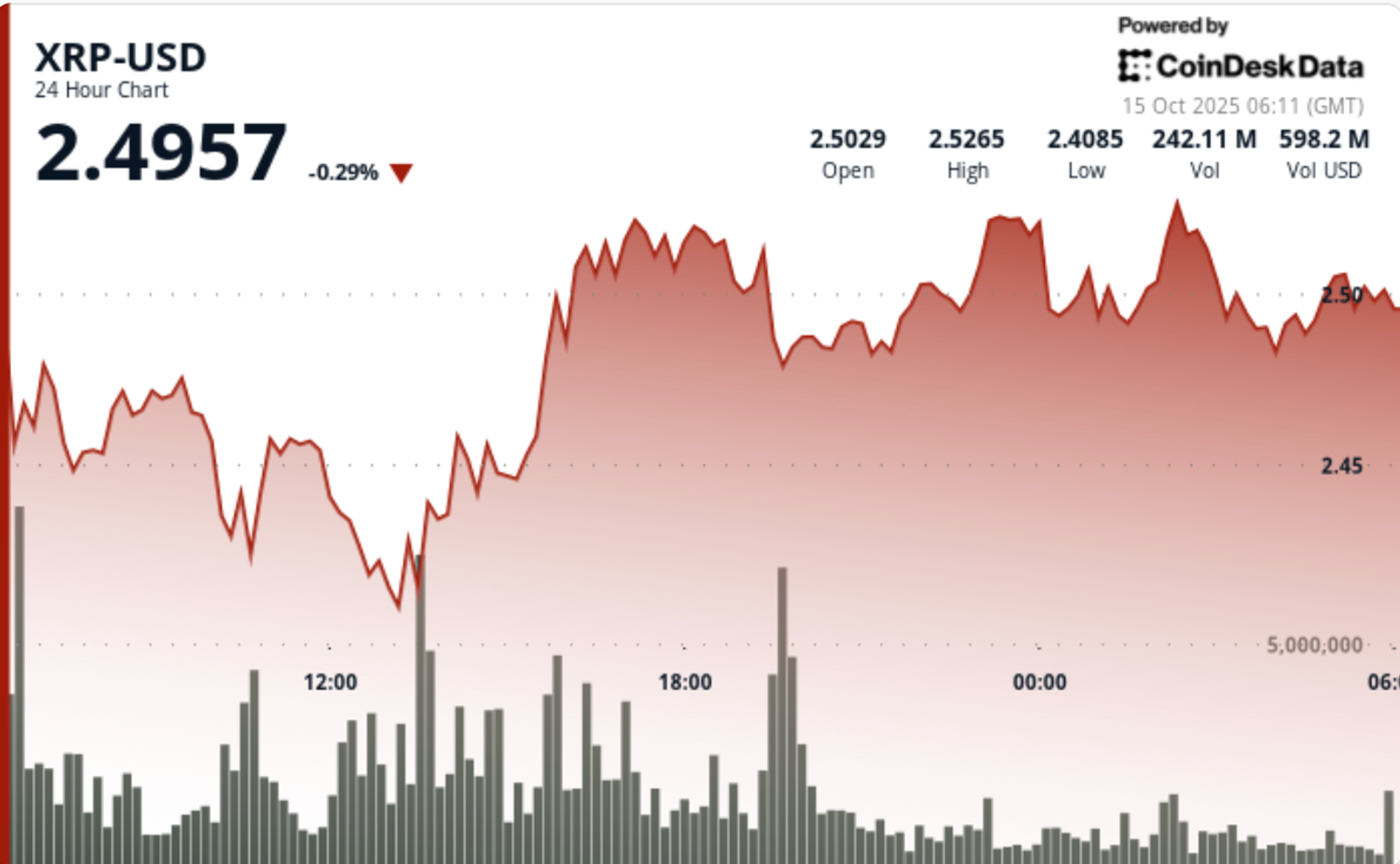

XRP's price is facing a potential 25% decline after the formation of a descending triangle pattern on its daily chart, coupled with significant selloffs by large investors, known as whales. Currently trading at $2.52, XRP has already dropped 12%, raising concerns among investors about further losses. This situation is crucial as it highlights the volatility in the cryptocurrency market and the impact of large holders on price movements.

— Curated by the World Pulse Now AI Editorial System