See what’s trending right now

Ripplein Cryptocurrency

3 hours agoXRP shows bullish momentum as traders anticipate a breakout, while Ripple's CEO prepares for a Senate testimony and the company nears a banking license amid ongoing SEC scrutiny.

Cryptocurrency

XRP Price Watch: Traders Eye Breakout as XRP Climbs From Pullback

positiveCryptocurrency

XRP is showing signs of life after a recent dip, with traders cautiously optimistic about a potential breakout. The cryptocurrency has clawed back some losses, and market watchers are keeping a close eye on whether this upward momentum holds.

Editor’s Note: For crypto investors, XRP’s rebound could signal a shift in sentiment—especially after a rough patch. If it breaks through key resistance levels, we might see renewed interest in the token. But as always in crypto, nothing’s guaranteed, so traders are staying alert.

Ripple CEO Brad Garlinghouse Set To Testify Before US Senate

neutralCryptocurrency

Ripple's CEO Brad Garlinghouse is heading to Capitol Hill next month to speak at a Senate Banking Committee hearing about the future of crypto markets. The session, dubbed "From Wall Street to Web3," will dig into how regulators should handle digital assets—likely touching on Ripple’s own high-stakes legal battles with the SEC. Expect fireworks, or at least some pointed questions.

Editor’s Note: This isn’t just another corporate exec testifying—it’s a big moment for crypto’s push for clearer rules. Ripple’s been in a years-long fight with regulators, so Garlinghouse’s testimony could sway how lawmakers view the industry. Whether it leads to friendlier policies or more red tape, the outcome will ripple through the entire market.

Ripple SEC News: XRP Nears Banking License And Faces Critical Support Test

neutralCryptocurrency

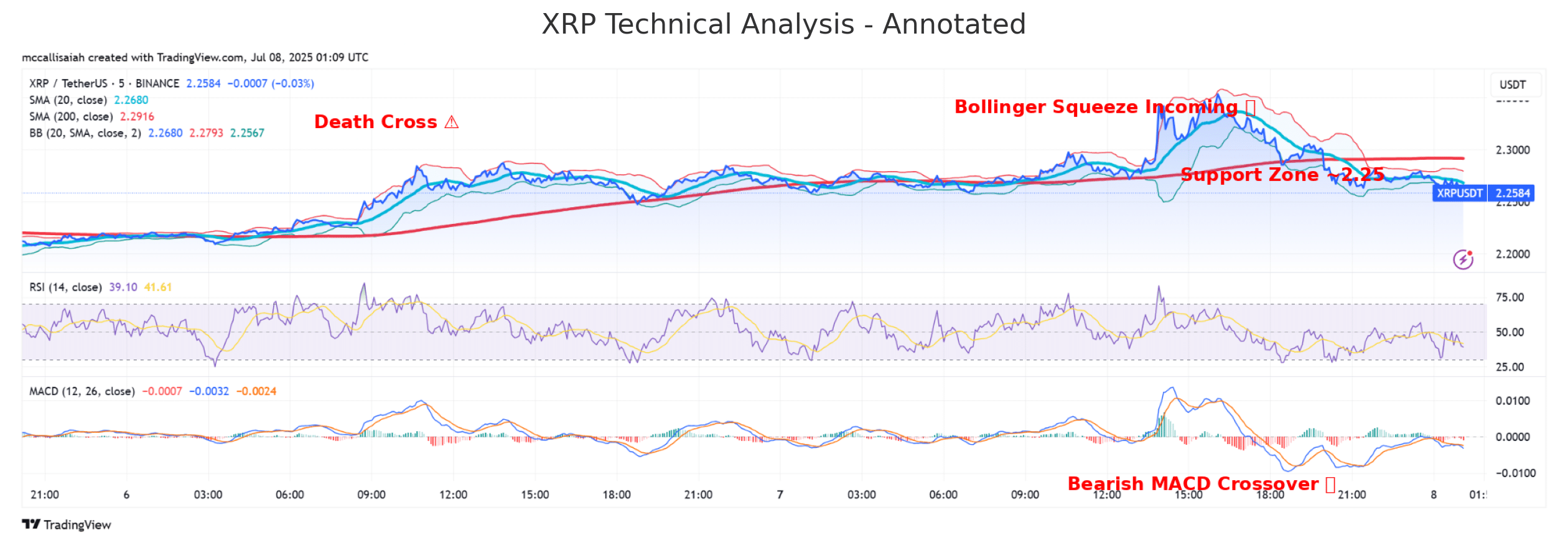

Ripple’s XRP is making waves with its bid to become a licensed bank, marking a big step for Web3 banking. Meanwhile, its price is teetering around $2.25 after a brief jump to $2.32, putting it at a make-or-break moment for traders. The article jokingly warns against liquidating your home to buy more XRP—but the broader takeaway is that this could be a pivotal moment for the crypto’s future.

Editor’s Note: If XRP secures a banking license, it could legitimize crypto’s role in traditional finance—a huge deal for an industry still fighting skepticism. But the price volatility reminds us that hype and reality don’t always move in sync. Whether you’re a crypto enthusiast or just watching from the sidelines, this story signals how blurry the line between digital assets and mainstream banking is getting.

XRP price must break this key level to reclaim $3

neutralCryptocurrency

XRP's price is showing some strength by turning a previous resistance zone into support, but it's still got a big hurdle to clear—the 200-day moving average at $2.36. If it can break past that, $3 might be back on the table. Until then, traders are watching closely to see if the bulls have enough momentum.

Editor’s Note: For anyone holding XRP or eyeing a trade, this is a make-or-break moment. Breaking past the 200-day moving average could signal a bigger rally, but if it stalls, the price might stay stuck in limbo. It’s a classic crypto standoff—bulls vs. resistance—and the outcome could shape short-term moves for one of the market’s most talked-about tokens.

XRP Builds Strength Above $2.26 With $2.38 in Sight. Next Leg Incoming?

positiveCryptocurrency

XRP, the cryptocurrency linked to Ripple, is showing strong momentum as it holds steady above $2.26 and eyes a potential climb to $2.38. Traders are buzzing about whether this signals the start of another upward surge—or if it’s just a temporary bump.

Editor’s Note: For crypto watchers, XRP’s resilience above key price levels is a big deal. If it breaks past $2.38, it could mean more gains ahead, fueling optimism (and maybe FOMO) among investors. But as always with crypto, nothing’s guaranteed—so keep an eye on those charts.

XRP Price Pops and Drops — Can Bulls Regain Control?

neutralCryptocurrency

XRP's price shot up past $2.25, even hitting $2.35 at one point, but then pulled back slightly below $2.30. It’s still holding above key support levels, though, and if it stays above $2.24, another rally could be in the cards.

Editor’s Note: For crypto traders, XRP’s recent moves are a classic tug-of-war between buyers and sellers. The brief surge and dip show volatility, but the fact that it’s holding above critical levels suggests bulls aren’t out of the game yet. If you’re watching XRP, the $2.24-$2.25 zone could be the make-or-break point for the next big swing.

Something Big Is Coming For XRP On July 9—Here’s Why It Matters

neutralCryptocurrency

The XRP community is buzzing because the US Senate Banking Committee is holding a major hearing on July 9—the most significant spotlight for XRP since Ripple’s legal battle with the SEC began. While details are still under wraps, the hearing could shape how regulators view XRP and other cryptocurrencies moving forward.

Editor’s Note: This isn’t just another bureaucratic meeting—it’s a potential turning point for XRP’s future. If the hearing leans favorably, it could signal smoother sailing for Ripple and XRP holders. But if regulators take a hard stance, it might mean more uncertainty. Either way, crypto watchers should pay attention—what happens here could ripple (pun intended) across the entire market.

Ripple CTO Makes Major Revelations: Early XRP Entry, Mined Bitcoins — Here’s The Details

positiveCryptocurrency

Ripple's CTO David Schwartz just dropped some juicy crypto nostalgia on social media—turns out he bought XRP at dirt-cheap prices back in the day and mined a stash of Bitcoin way before it was cool. Think of it like finding out your tech-savvy uncle had a garage full of vintage Apple computers before anyone knew they'd be worth millions.

Editor’s Note: For crypto enthusiasts, this is like peeking behind the curtain of early blockchain history. Schwartz’s revelations highlight how far the industry has come—and how much early adopters stood to gain. It’s a mix of humblebragging and a reminder that in crypto, timing (and a bit of luck) can mean everything.

XRP Price Brewing A Monster Rally? This Patter Might Hold The Key

positiveCryptocurrency

Crypto analysts are buzzing about XRP's recent uptick, with some predicting a major rally ahead. The token has gained nearly 7% in a week and is flirting with $2.33, showing strength while much of the crypto market stagnates. Experts point to a bullish technical pattern forming—suggesting it could retest past highs. One bold forecast even floats a $20-$30 target, though that’s far from guaranteed.

Editor’s Note: For XRP holders, this could be the glimmer of hope they’ve waited for after years of legal drama and sluggish price action. But crypto’s volatile—patterns don’t always play out, and hype can fizzle fast. Still, if the momentum holds, it might shake up the broader altcoin market. Keep an eye on it, but maybe don’t bet the farm just yet.

Why World Pulse Now?

Global Coverage

All major sources, one page

Emotional Lens

Feel the mood behind headlines

Trending Topics

Know what’s trending, globally

Read Less, Know More

Get summaries. Save time

Stay informed, save time

Learn moreLive Stats

Articles Processed

9,078

Trending Topics

168

Sources Monitored

211

Last Updated

2 hours ago

Live data processing

How it works1-Minute Daily Briefing

Stay sharp in 60 seconds. Get concise summaries of today’s biggest stories — markets, tech, sports, and more

Why World Pulse Now?

Global Coverage

All major sources, one page

Emotional Lens

Feel the mood behind headlines

Trending Topics

Know what’s trending, globally

Read Less, Know More

Get summaries. Save time

Stay informed, save time

Learn moreLive Stats

Articles Processed

9,078

Trending Topics

168

Sources Monitored

211

Last Updated

2 hours ago

Live data processing

How it works1-Minute Daily Briefing

Stay sharp in 60 seconds. Get concise summaries of today’s biggest stories — markets, tech, sports, and more