AstraZeneca Gets Rare Sell as Deutsche Bank Has Pipeline Worries

NegativeFinancial Markets

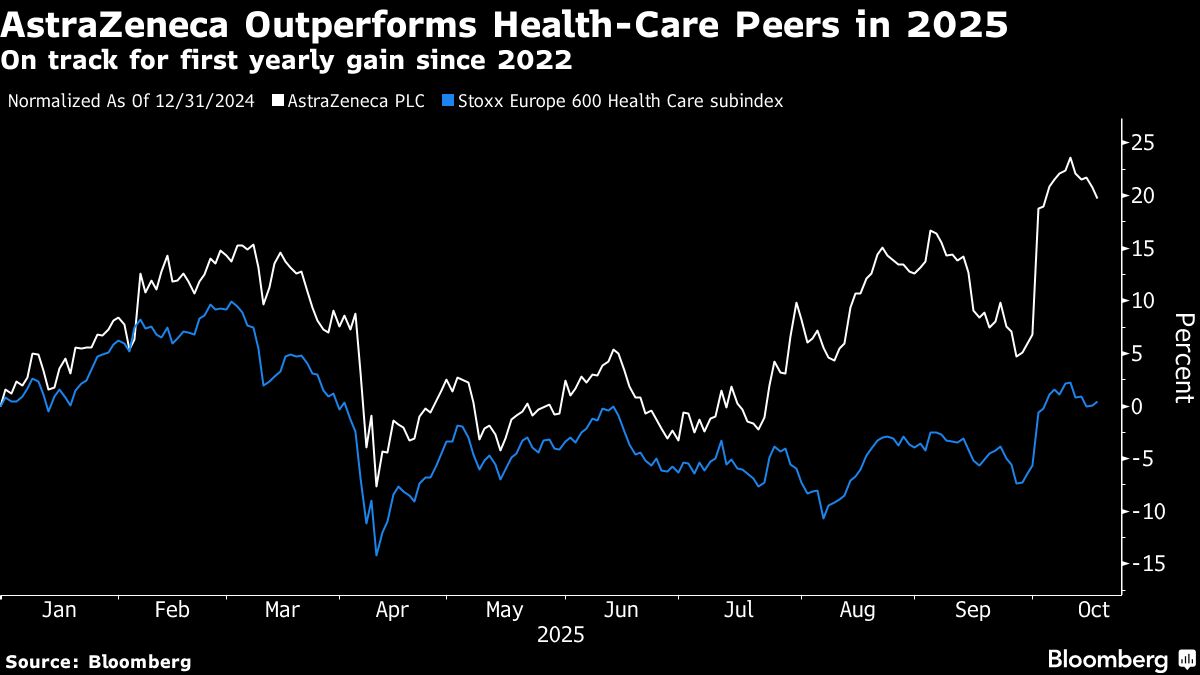

AstraZeneca has received an unusual sell rating from Deutsche Bank, raising concerns about its drug pipeline, especially regarding breast cancer treatments. This downgrade is significant as it reflects growing skepticism among analysts about the company's future prospects, which could impact investor confidence and the stock's performance.

— Curated by the World Pulse Now AI Editorial System