Health Care Roundup: Market Talk

NeutralFinancial Markets

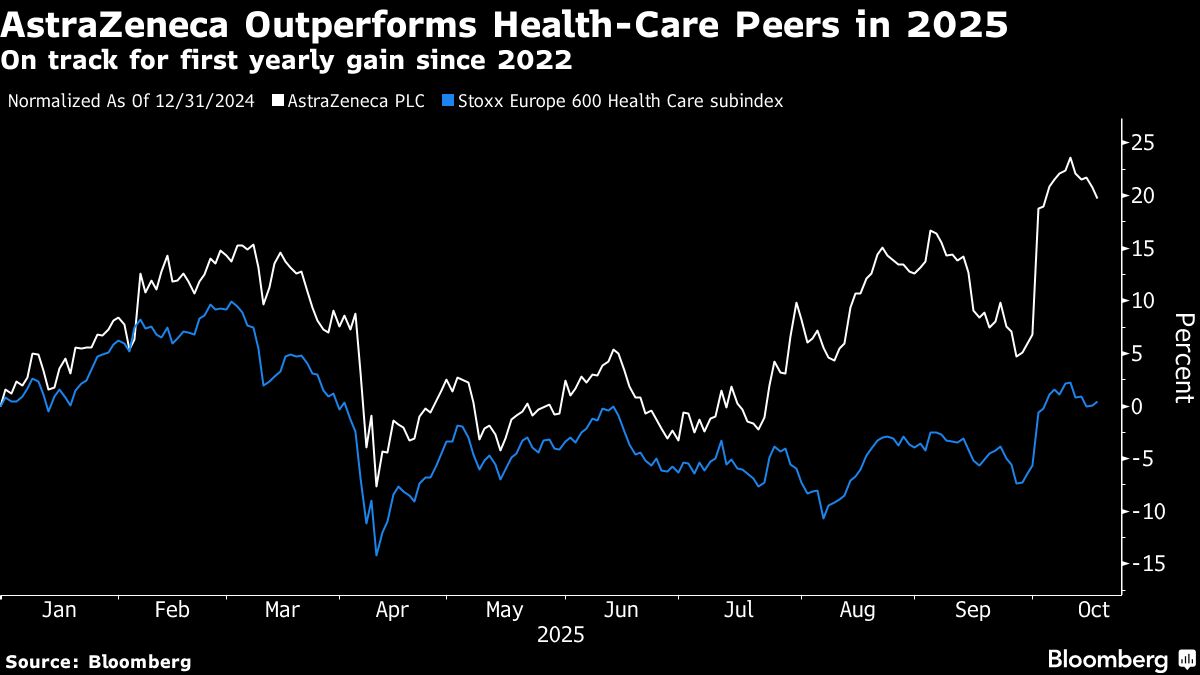

The latest Market Talks provide valuable insights into key players in the health care sector, including AstraZeneca, Merck KGaA, and Sartorius. Understanding the dynamics of these companies is crucial for investors and stakeholders as they navigate the evolving landscape of health care, which continues to be a significant area of interest and investment.

— Curated by the World Pulse Now AI Editorial System