The Fed and Big Tech Re-Raise Investors’ Spirits

PositiveFinancial Markets

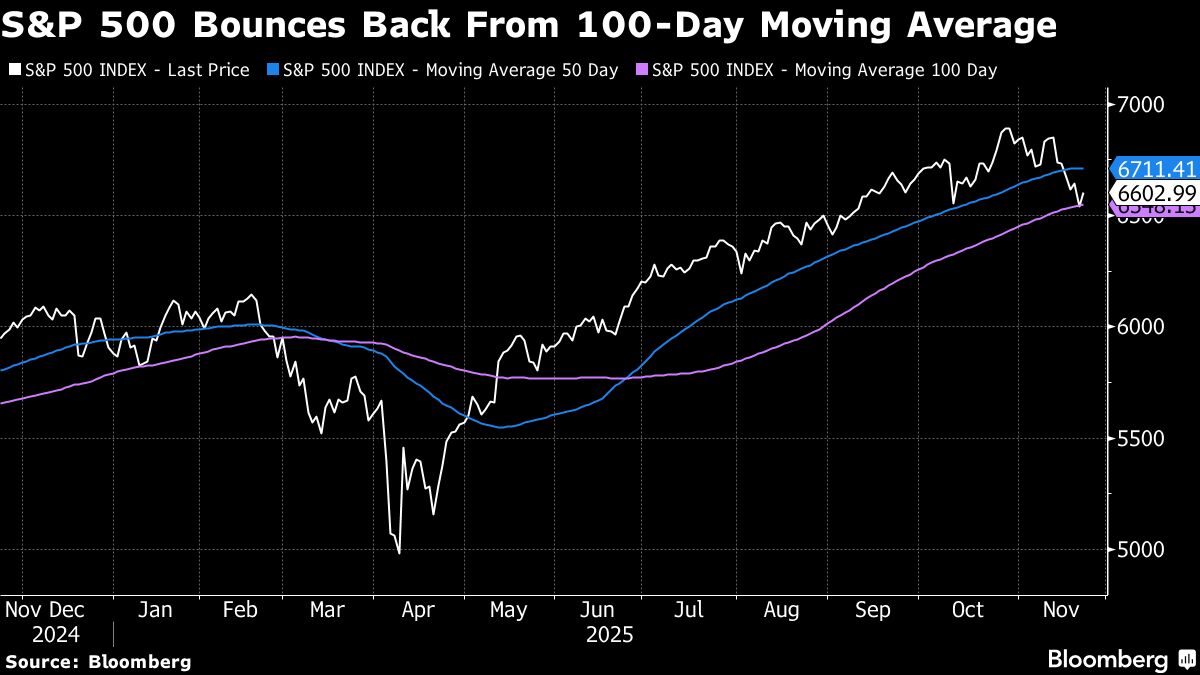

- The Federal Reserve's recent actions, alongside the resilience shown by major technology companies, have uplifted investor sentiment, suggesting a potential recovery in the markets. This positive shift comes after a period of volatility and uncertainty, particularly in the tech sector, where valuations have been under scrutiny.

- This development is significant for investors as it indicates a renewed confidence in both the Federal Reserve's monetary policies and the performance of Big Tech. The interplay between these factors is crucial for market stability and growth, especially after recent downturns.

- The broader market context reveals a mixed sentiment among investors, with ongoing concerns about high valuations in the tech sector and the impact of economic indicators. While some investors are optimistic about buying opportunities following recent selloffs, others remain cautious due to potential volatility driven by economic uncertainties and the evolving landscape of artificial intelligence.

— via World Pulse Now AI Editorial System