Asian Stocks Track US Gains on Fed Rate Cut Bets: Markets Wrap

PositiveFinancial Markets

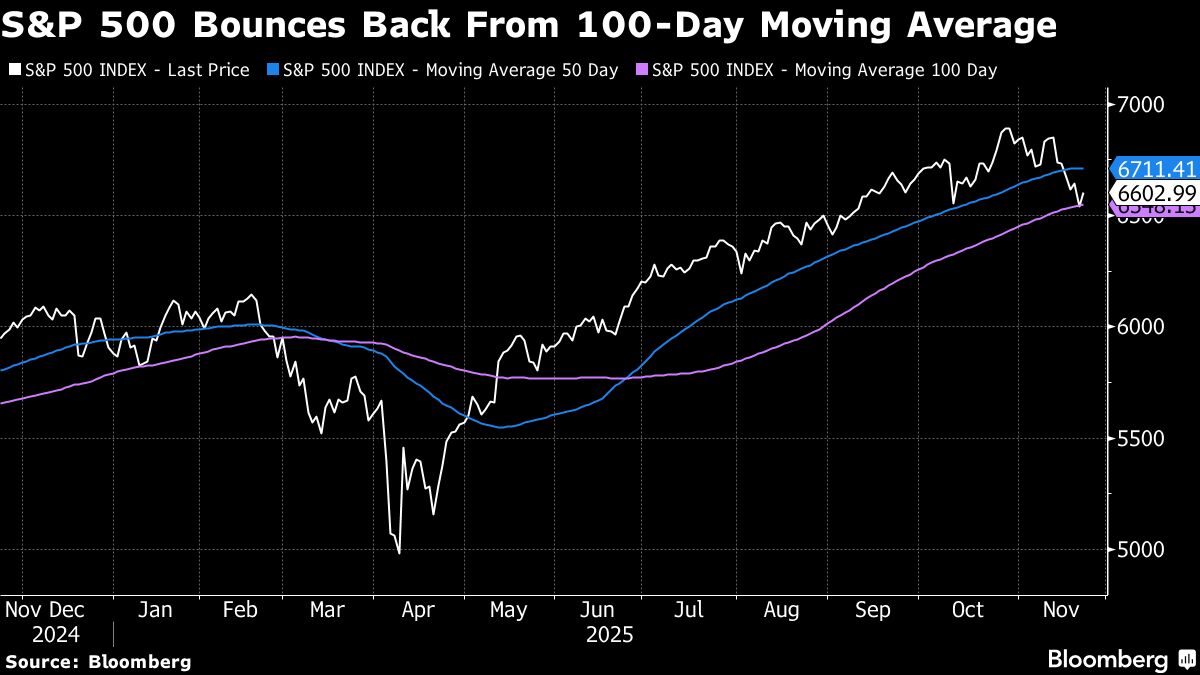

- Asian stocks followed Wall Street's upward trend as optimism grew regarding a potential interest rate cut by the Federal Reserve in December, alongside a rebound in technology shares. This shift comes after a week of volatility marked by concerns over inflation and a tech bubble.

- The anticipated rate cut could provide much-needed relief to investors and stimulate economic activity, particularly in the technology sector, which has faced significant fluctuations recently. A successful cut may bolster market confidence and encourage investment.

- The broader market context reveals a mixed sentiment among investors, with some expressing caution due to ongoing concerns about a tech bubble and the implications of recent jobs data on the Fed's decision-making. This uncertainty reflects a complex interplay between economic indicators and market reactions, highlighting the challenges facing both investors and policymakers.

— via World Pulse Now AI Editorial System