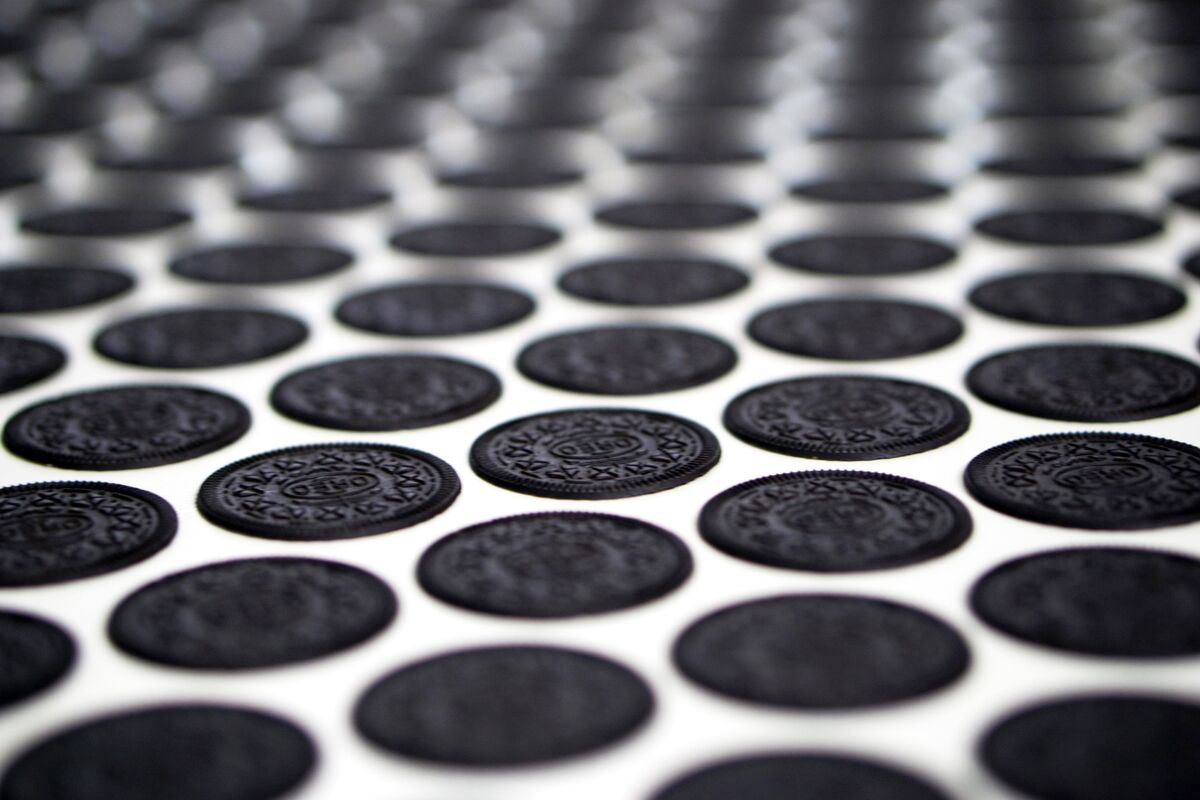

Mondelez defeats greenwashing lawsuit over ’climate neutral’ Clif Bar claim

PositiveFinancial Markets

Mondelez has successfully defended itself against a greenwashing lawsuit concerning its 'climate neutral' claims for Clif Bar. This victory is significant as it highlights the challenges faced by companies in navigating environmental marketing claims while maintaining transparency. The outcome may set a precedent for how similar cases are handled in the future, potentially influencing corporate practices in sustainability.

— Curated by the World Pulse Now AI Editorial System