Nvidia nears historic $5 trillion valuation in fresh AI-fueled rally

PositiveFinancial Markets

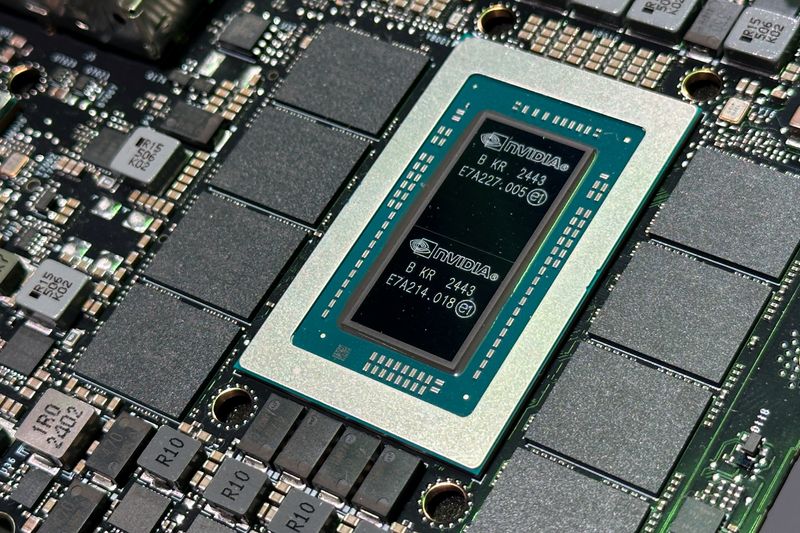

Nvidia is on the brink of achieving a remarkable $5 trillion valuation, driven by a surge in interest and investment in artificial intelligence. This milestone is significant not only for Nvidia but also for the tech industry as a whole, highlighting the growing importance of AI technologies in shaping the future of business and innovation.

— Curated by the World Pulse Now AI Editorial System