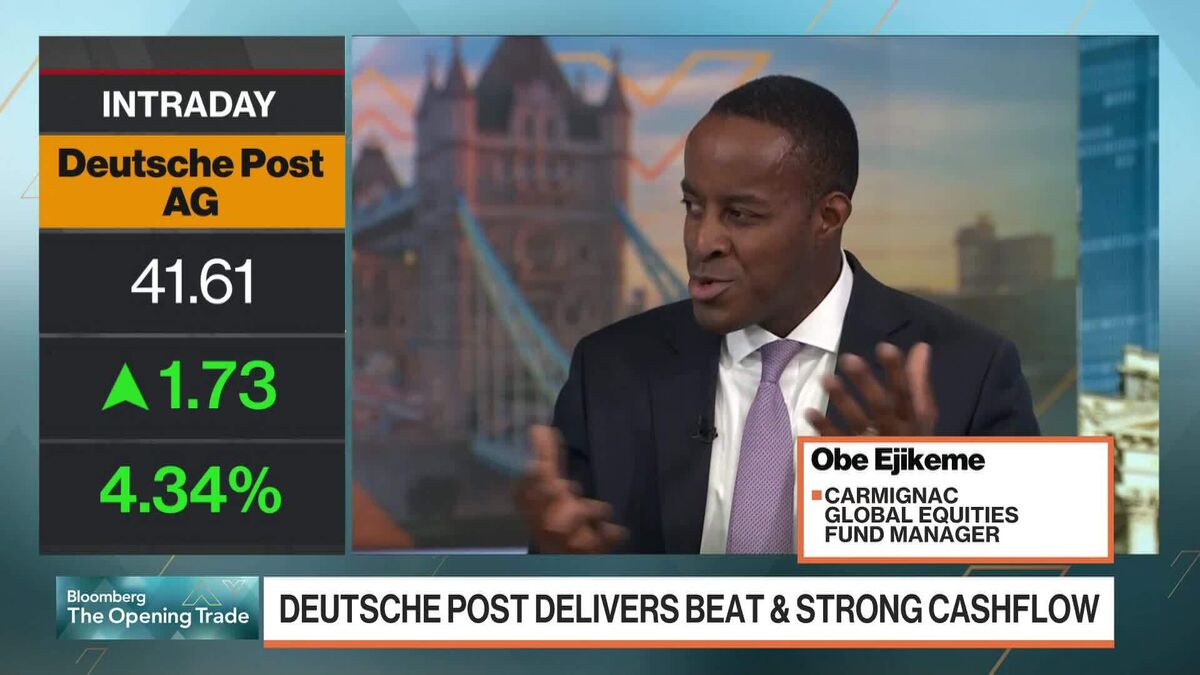

Focus on Long-Term AI Megatrend, ‘Stay Sane’: Carmignac

PositiveFinancial Markets

Focus on Long-Term AI Megatrend, ‘Stay Sane’: Carmignac

Carmignac's Obe Ejikeme emphasizes the importance of a long-term perspective on the AI megatrend, suggesting that investors should not overly concentrate their investments in this area. He believes that the AI market will evolve significantly over the next 5 to 10 years, and advocates for a balanced approach to risk management. This insight is crucial as it encourages investors to think strategically about their portfolios in a rapidly changing technological landscape.

— via World Pulse Now AI Editorial System