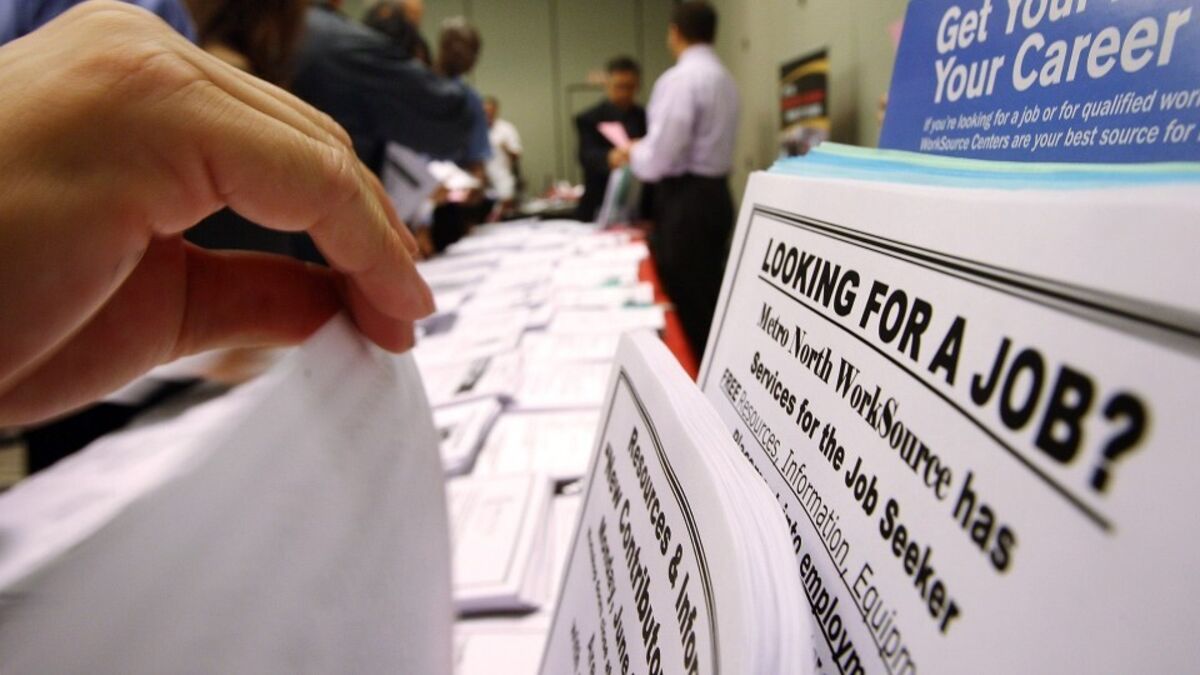

US Posts Most October Layoffs in More Than 20 Years

NegativeFinancial Markets

US Posts Most October Layoffs in More Than 20 Years

In a concerning trend, US companies reported the highest number of job cuts for any October in over 20 years, with 153,074 layoffs announced last month. This figure is nearly three times higher than the same month last year, highlighting a significant shift in the job market. The data from Challenger, Gray & Christmas indicates that economic pressures may be forcing companies to make tough decisions, which could have lasting impacts on workers and the economy as a whole.

— via World Pulse Now AI Editorial System