Mercuria Metals Boss Says ‘This Is the Big One’ for Copper Bulls

PositiveFinancial Markets

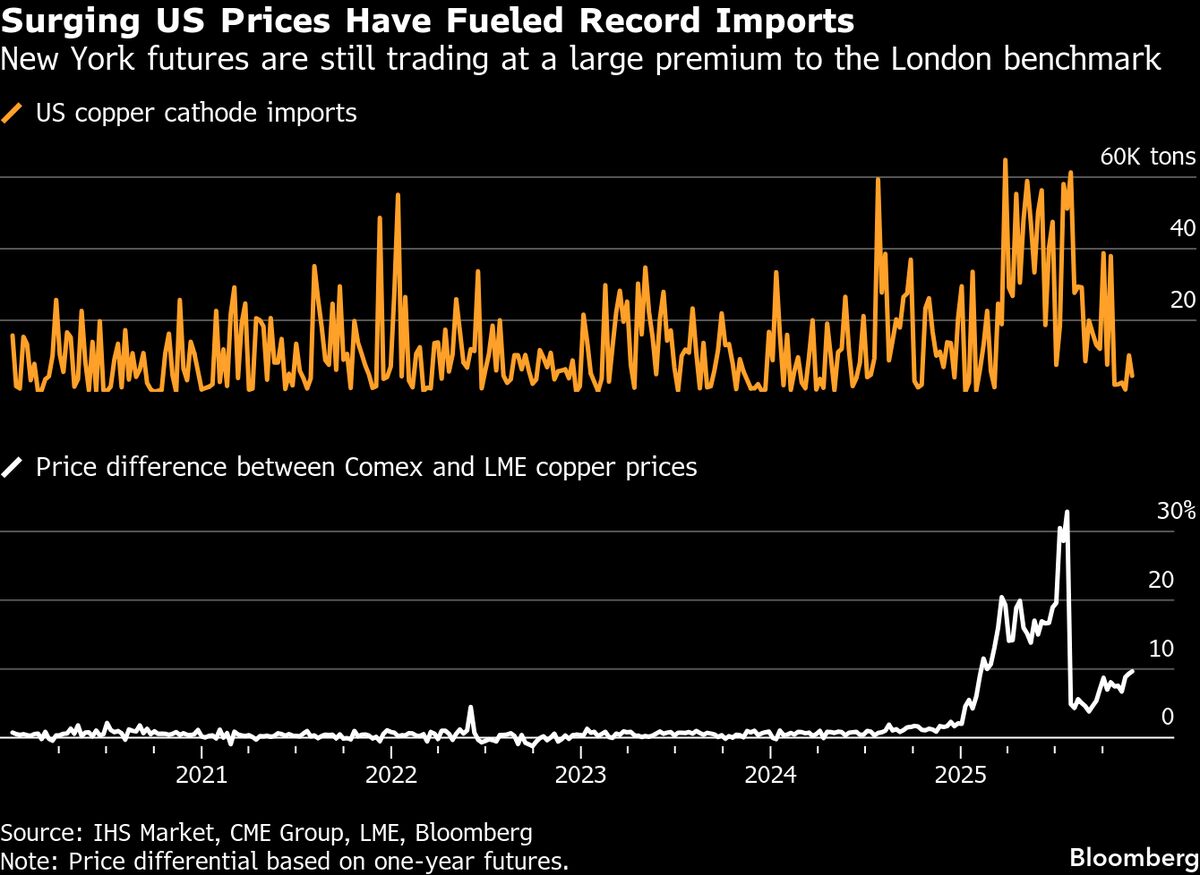

- Kostas Bintas, the head of metals at Mercuria Energy Group Ltd., has expressed renewed optimism for copper prices, indicating that a surge in shipments to the US could deplete global inventories. This statement underscores a pivotal moment for copper bulls as market dynamics shift.

- This development is significant for Mercuria as it positions the company to capitalize on rising copper prices, which are driven by increasing demand and potential supply shortages. Bintas's bullish stance may attract investor interest and enhance the company's market presence.

- The broader copper market is witnessing a structural bull case, with forecasts suggesting prices could reach unprecedented levels due to strong demand from sectors like renewable energy and electric vehicles. Analysts predict sustained price increases amid supply disruptions and geopolitical tensions, reflecting a growing confidence in copper as a critical commodity for future economic growth.

— via World Pulse Now AI Editorial System