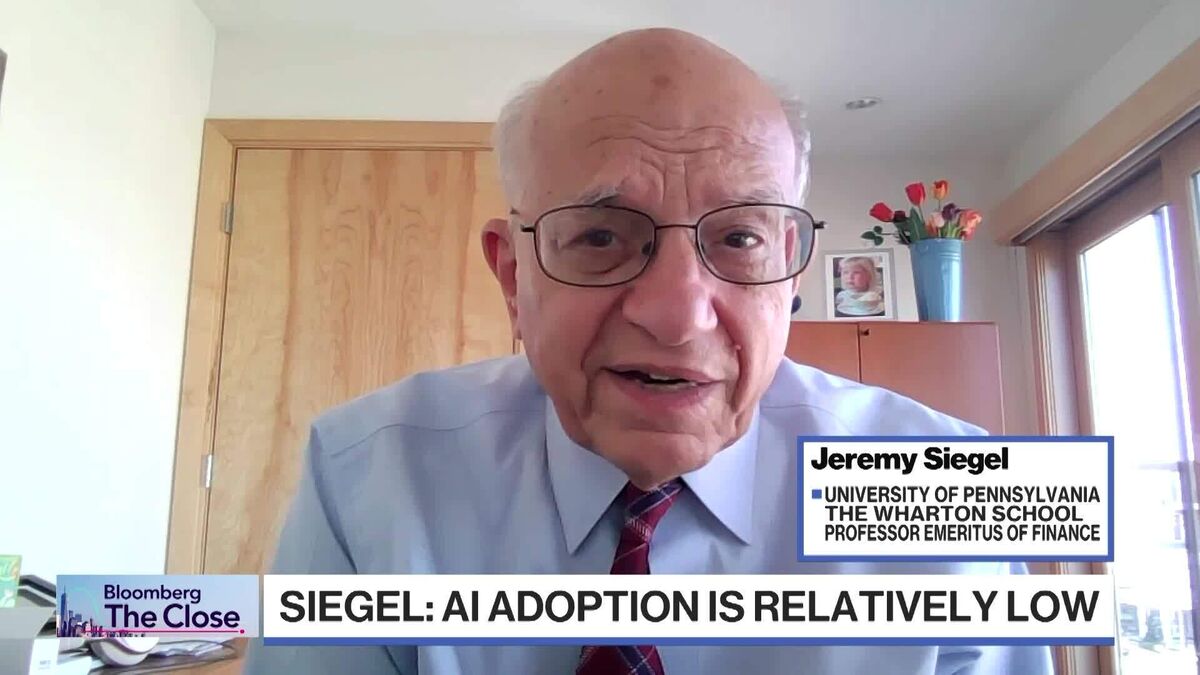

The Choices for Fed Chair Are "Excellent People": Siegel

PositiveFinancial Markets

Jeremy Siegel, a finance professor at the Wharton School, expressed confidence in the potential candidates for the Federal Reserve chair position, describing them as 'excellent people.' He reassured that there is no serious threat to the Fed's independence, highlighting the qualifications of the candidates. This is significant as it reflects stability and competence in a crucial economic role, which can influence market confidence and economic policy.

— Curated by the World Pulse Now AI Editorial System