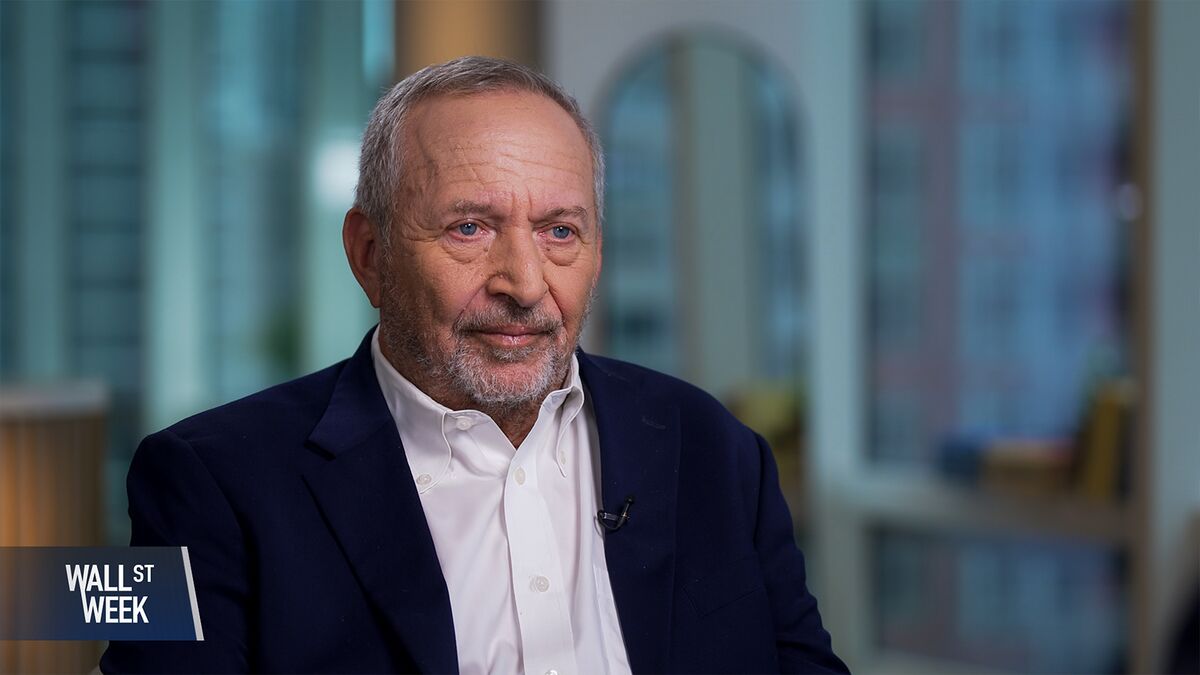

Fed Faces 'Unprecedented' Inflation vs. Jobs Dilemma, Larry Summers Says

NeutralFinancial Markets

Former Treasury Secretary Lawrence H. Summers has highlighted the unique challenges the Federal Reserve faces today, particularly the balancing act between controlling inflation and maintaining employment levels. He suggests that the current economic climate is unprecedented, with recent rate cuts potentially increasing the risk of inflation over unemployment. This discussion is crucial as it reflects the complexities of monetary policy in a rapidly changing economic landscape.

— Curated by the World Pulse Now AI Editorial System