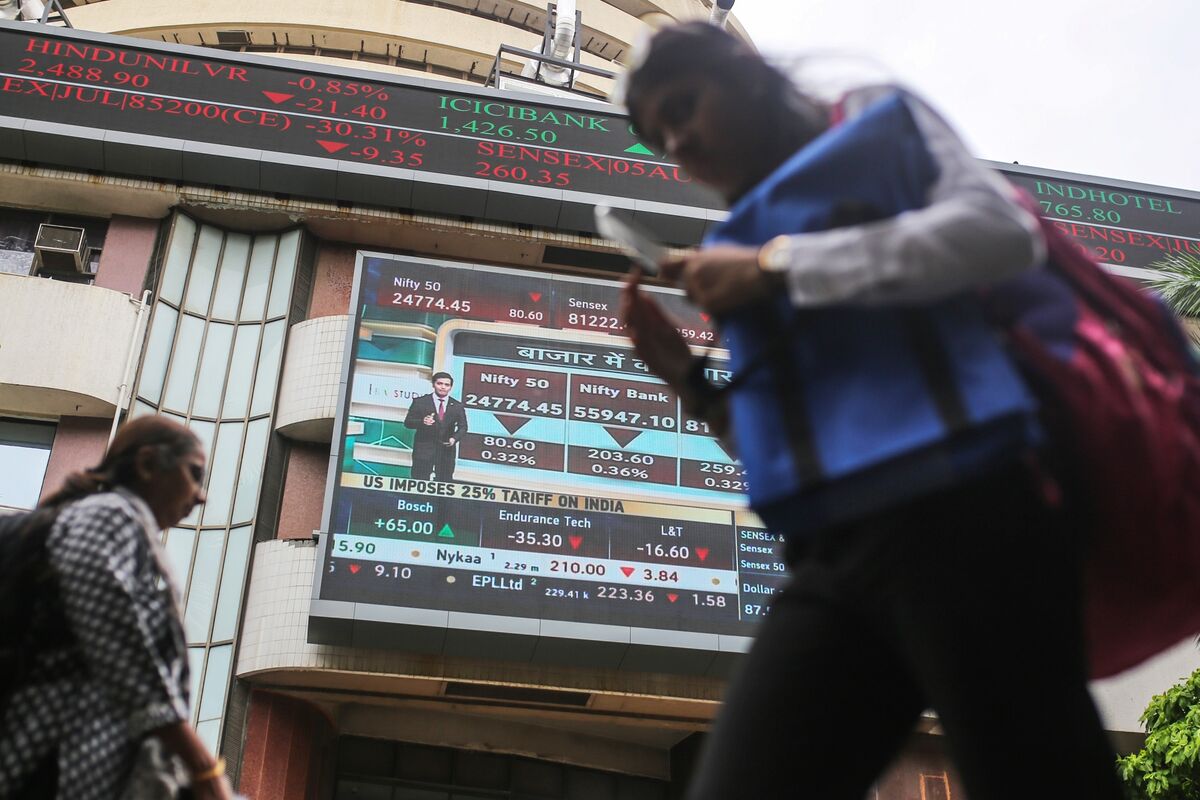

Indian Traders Watch For a New Nifty Record High

PositiveFinancial Markets

Indian traders are eagerly anticipating a potential new record high for the Nifty index as the trading day begins. This optimism reflects a broader confidence in the market, driven by recent economic indicators and investor sentiment. A new high could signal a strong recovery and growth potential, making it an important moment for investors and the economy.

— Curated by the World Pulse Now AI Editorial System