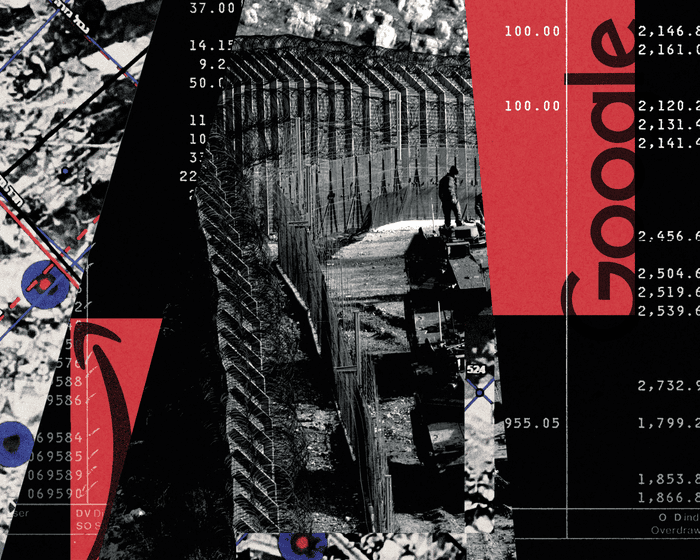

Monzo Boss TS Anil Steps Down to Make Way for Google Executive

NeutralFinancial Markets

TS Anil, the CEO of Monzo Bank, is stepping down after nearly six years at the helm, paving the way for a new leader from Google. This transition is significant as it marks a new chapter for the London-based fintech, which has been a key player in the banking sector. The change in leadership could bring fresh perspectives and strategies to Monzo, potentially impacting its growth and innovation in the competitive financial landscape.

— Curated by the World Pulse Now AI Editorial System