Fed rate cuts loom, but dollar’s long game looks stronger than most expect

PositiveFinancial Markets

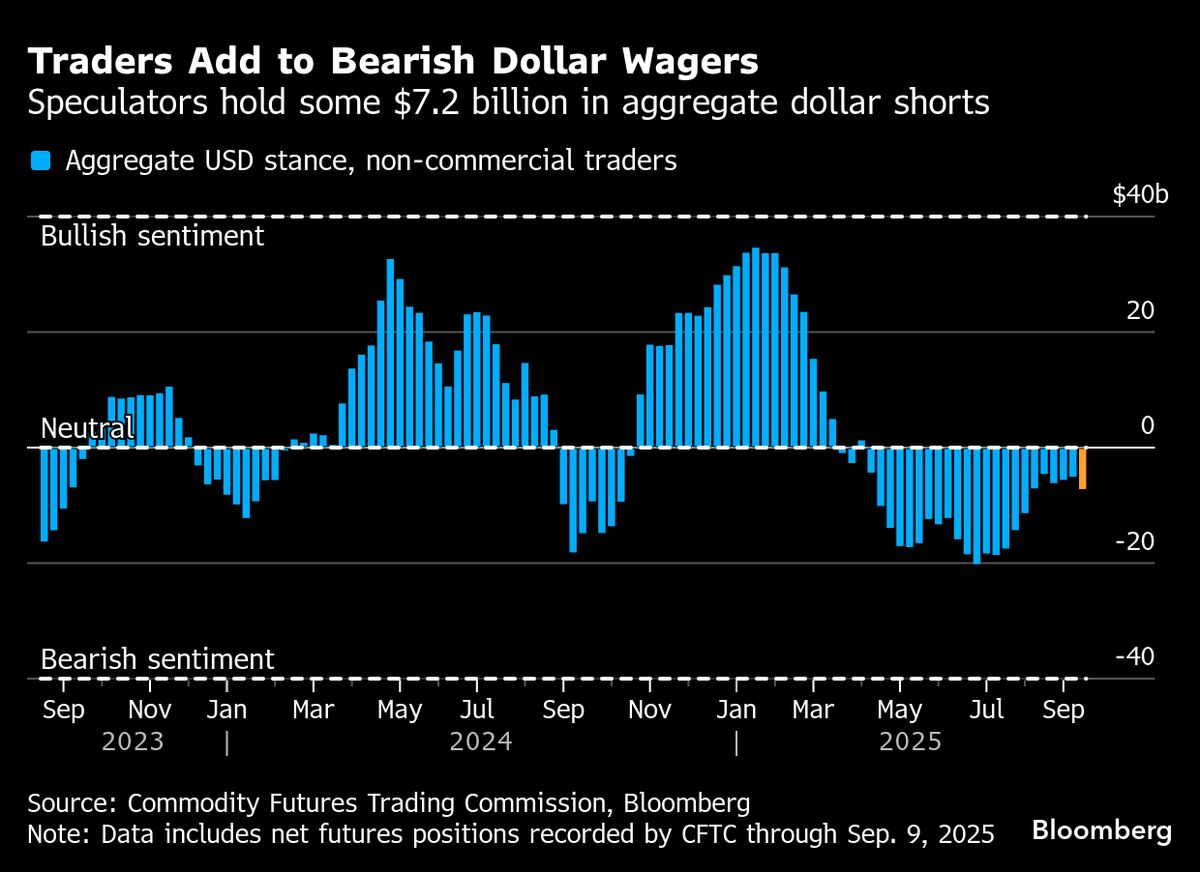

As the Federal Reserve considers rate cuts, the strength of the dollar is surprising many analysts. While some fear that lower interest rates could weaken the currency, the dollar's long-term prospects appear robust due to strong economic fundamentals. This matters because a strong dollar can influence global trade dynamics and impact inflation rates, making it a key focus for investors and policymakers alike.

— Curated by the World Pulse Now AI Editorial System