Dollar and shares languish, gold glitters as Fed verdict looms large

NeutralFinancial Markets

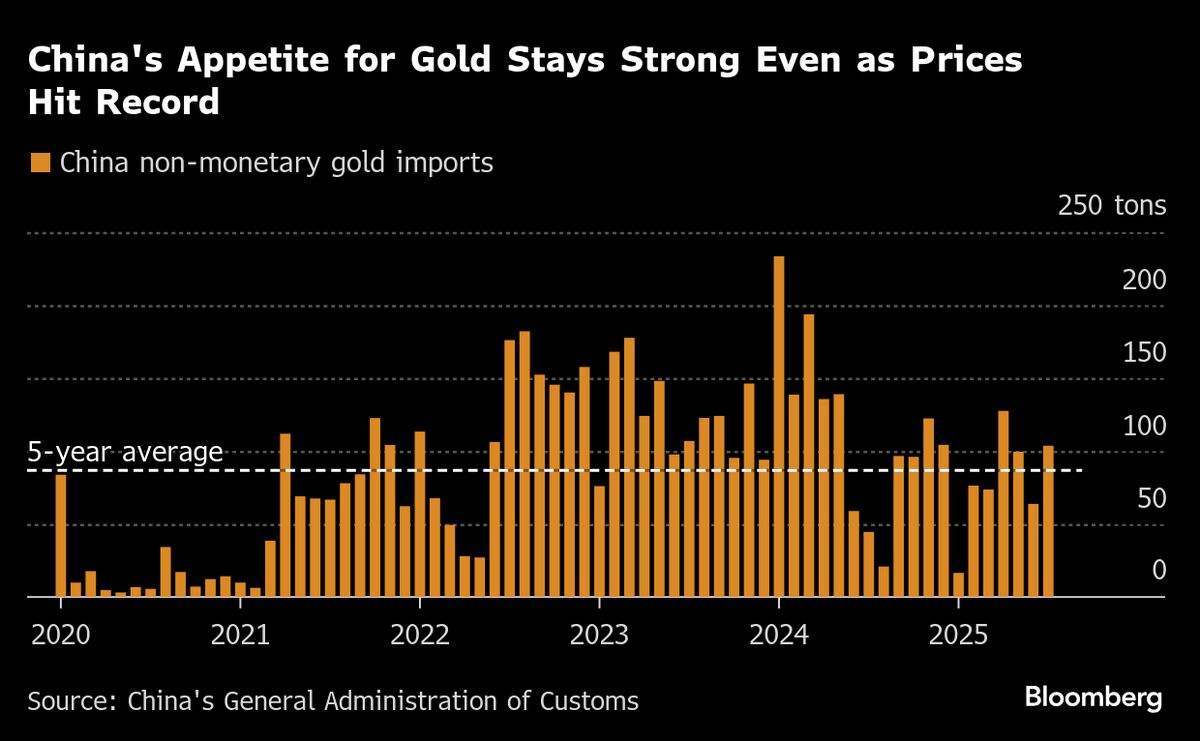

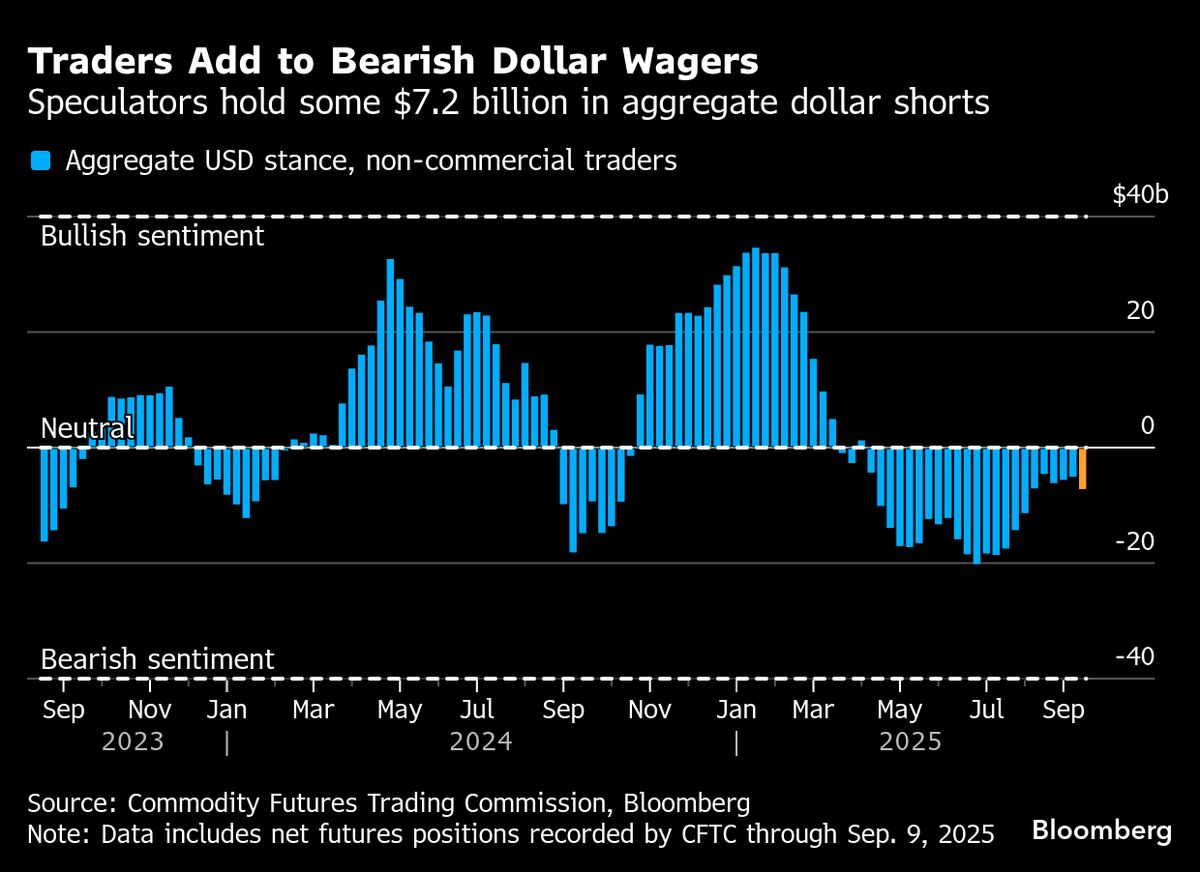

As the Federal Reserve prepares to announce its latest decisions, the financial markets are experiencing a mixed bag of reactions. The dollar and shares are struggling, reflecting uncertainty among investors, while gold is shining brightly as a safe haven asset. This situation highlights the ongoing volatility in the economy and the importance of the Fed's verdict, which could significantly influence market trends and investor confidence.

— Curated by the World Pulse Now AI Editorial System