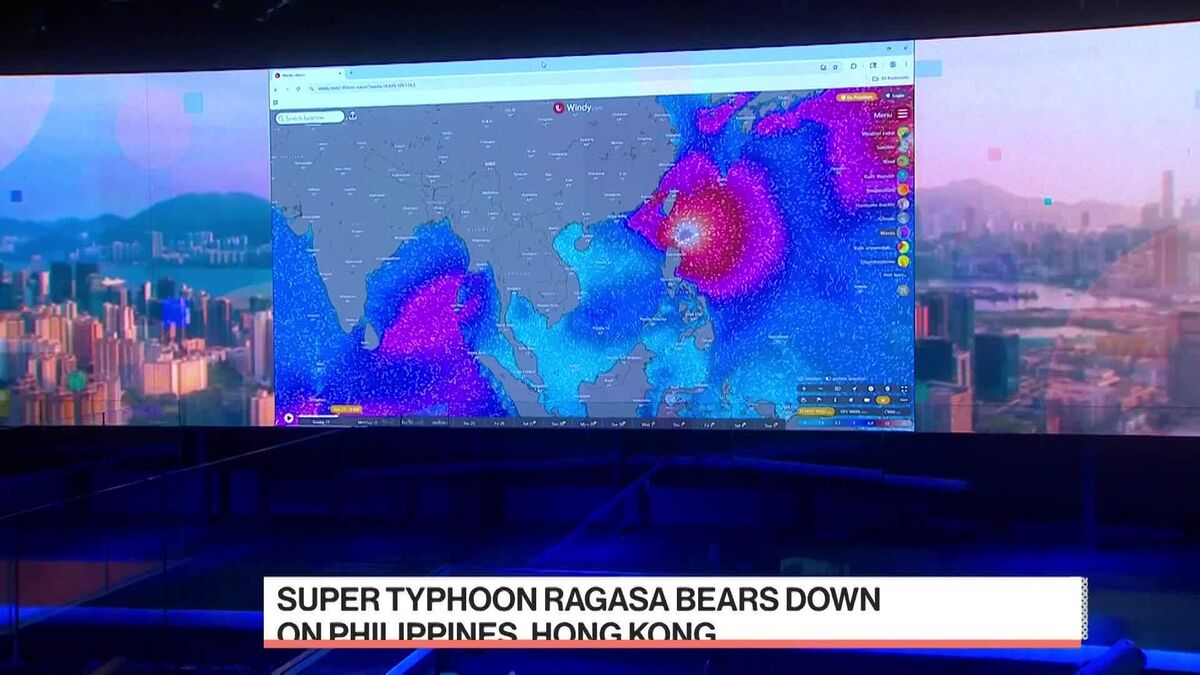

World’s Biggest Listing at Risk of Delay Because of Typhoon

NegativeFinancial Markets

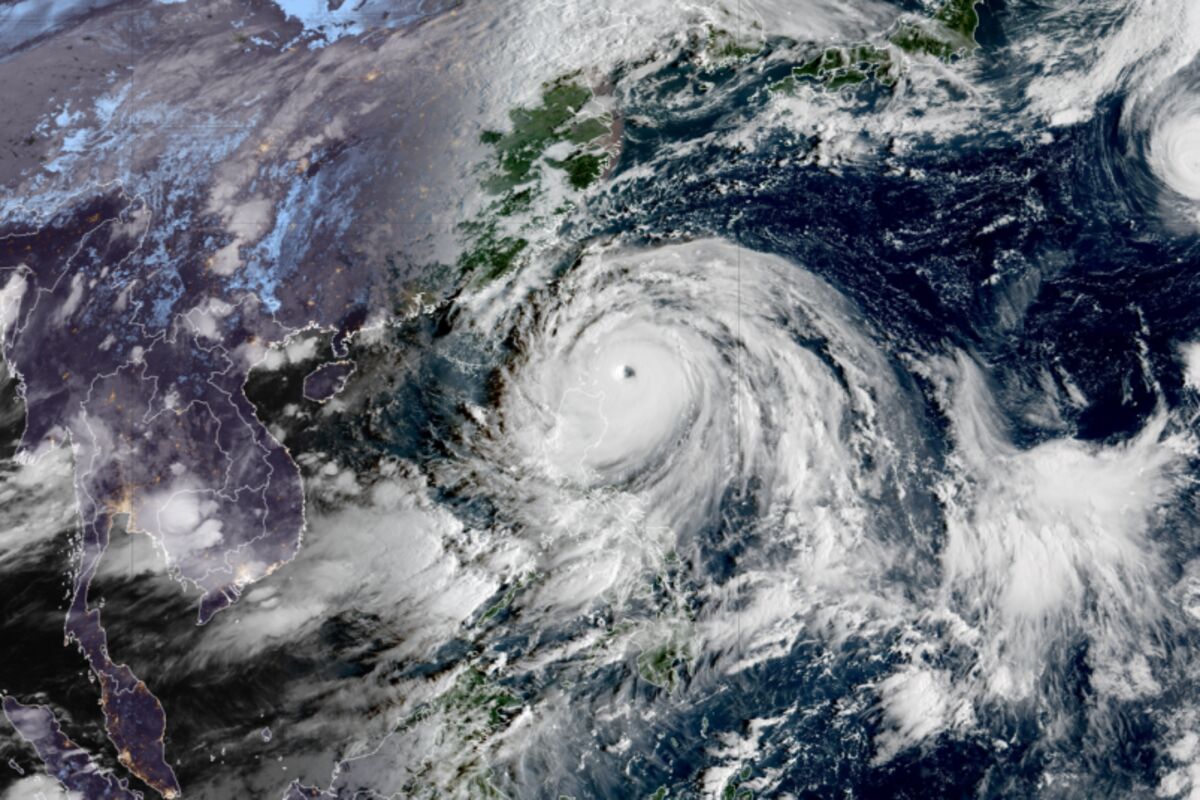

Zijin Gold International Co. is facing potential delays in its highly anticipated $3.2 billion initial public offering due to the threat of super typhoon Ragasa. This IPO is significant as it represents the largest listing in months, and any postponement could impact investor confidence and market dynamics in Hong Kong. The situation highlights the intersection of natural events and financial markets, reminding us how external factors can influence major economic activities.

— Curated by the World Pulse Now AI Editorial System