US outlines growth, deregulation, energy as priorities for G20 presidency, sources say

PositiveFinancial Markets

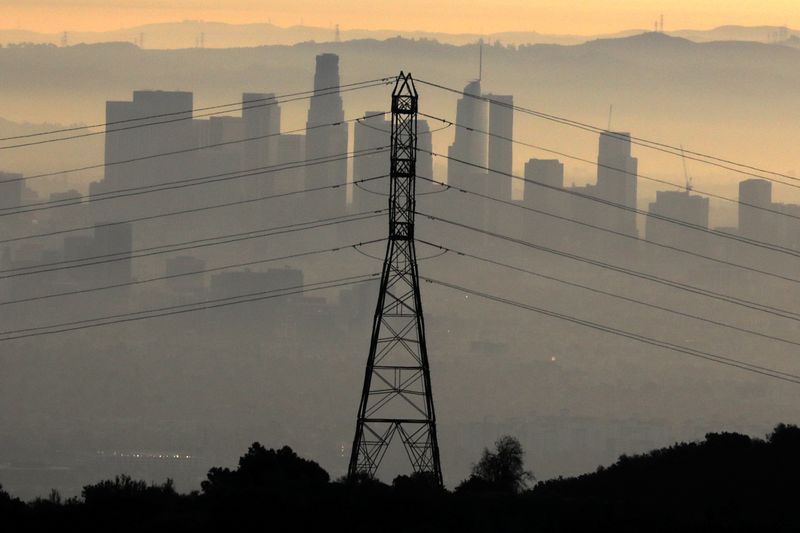

The United States has outlined its key priorities for its upcoming G20 presidency, focusing on growth, deregulation, and energy. This is significant as it reflects the US's commitment to fostering international cooperation and addressing global economic challenges. By emphasizing these areas, the US aims to lead discussions that could shape policies impacting economies worldwide, making it a pivotal moment for global collaboration.

— Curated by the World Pulse Now AI Editorial System