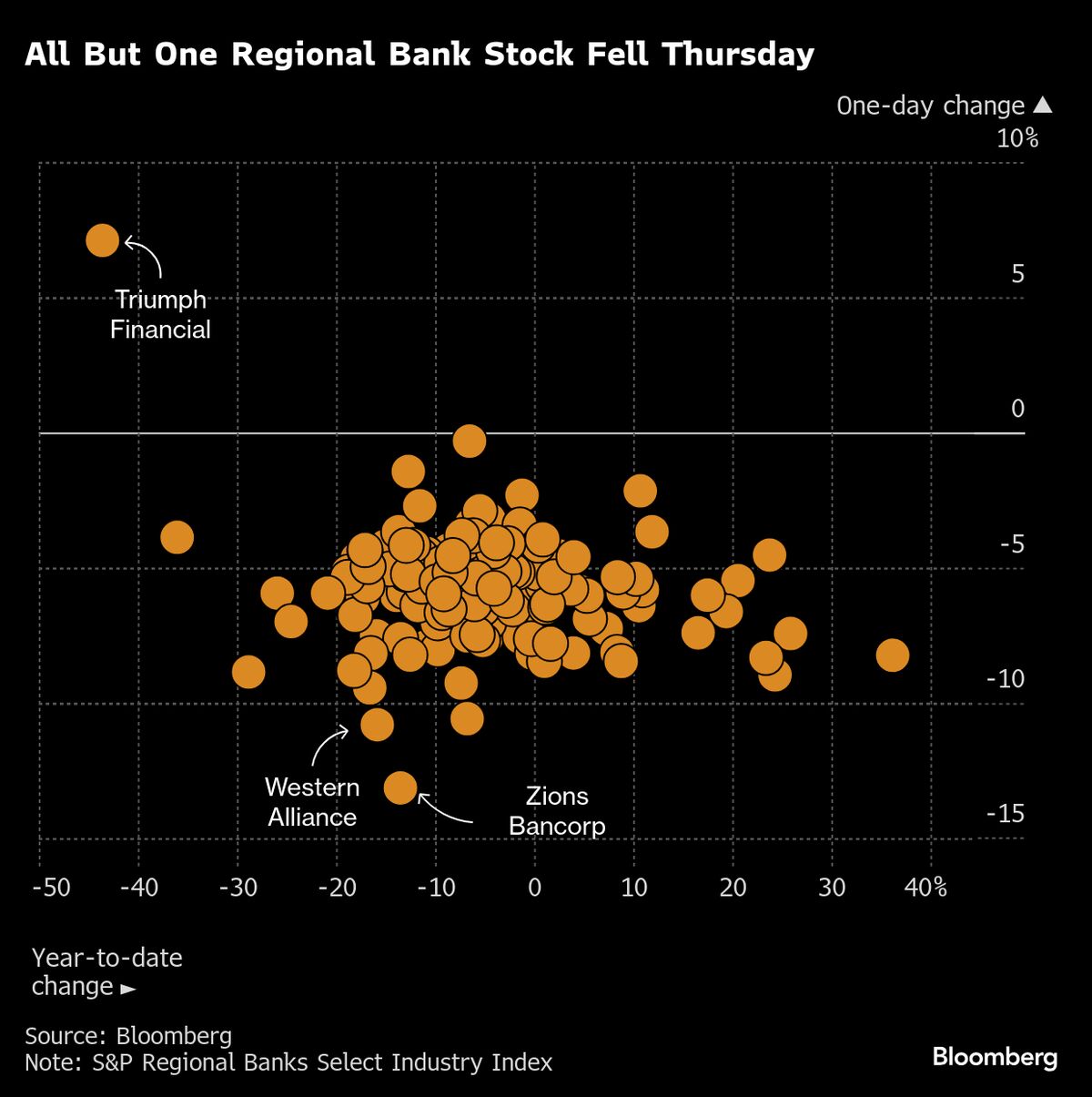

New Credit Fraud Fears Raise More Worries About Regional Banks

NegativeFinancial Markets

Recent developments have raised significant concerns about regional banks as shares plummeted following revelations of connections between these banks and borrowers implicated in fraud. This situation is alarming because it not only affects the banks' reputations but also raises questions about the stability of the financial system, potentially impacting consumers and investors alike.

— Curated by the World Pulse Now AI Editorial System