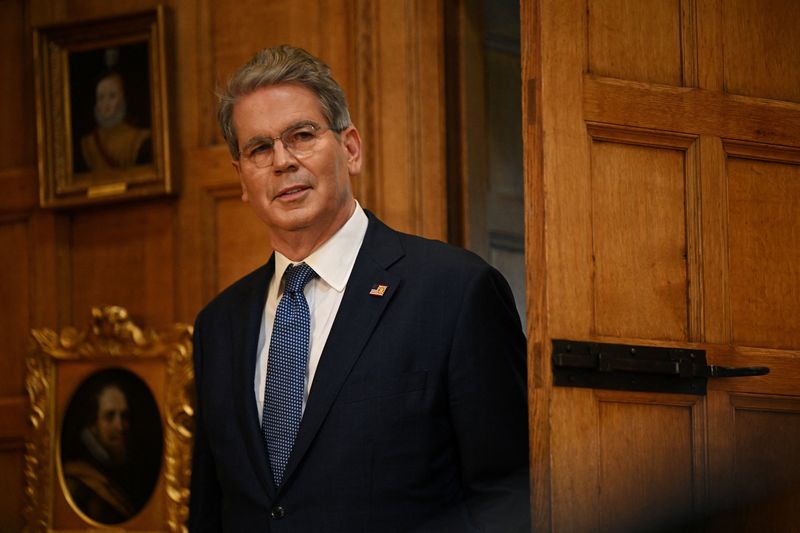

Dollar-Hungry Milei Pauses Crop Tariffs Ahead of Argentine Vote

PositiveFinancial Markets

In a strategic move ahead of the midterm elections, Argentine President Javier Milei has temporarily eliminated export tariffs on all crop shipments. This decision aims to attract foreign currency and stabilize the market amid a sell-off, highlighting the government's focus on boosting the agricultural sector and supporting the economy. It's a significant step that could influence voter sentiment and the overall economic landscape in Argentina.

— Curated by the World Pulse Now AI Editorial System