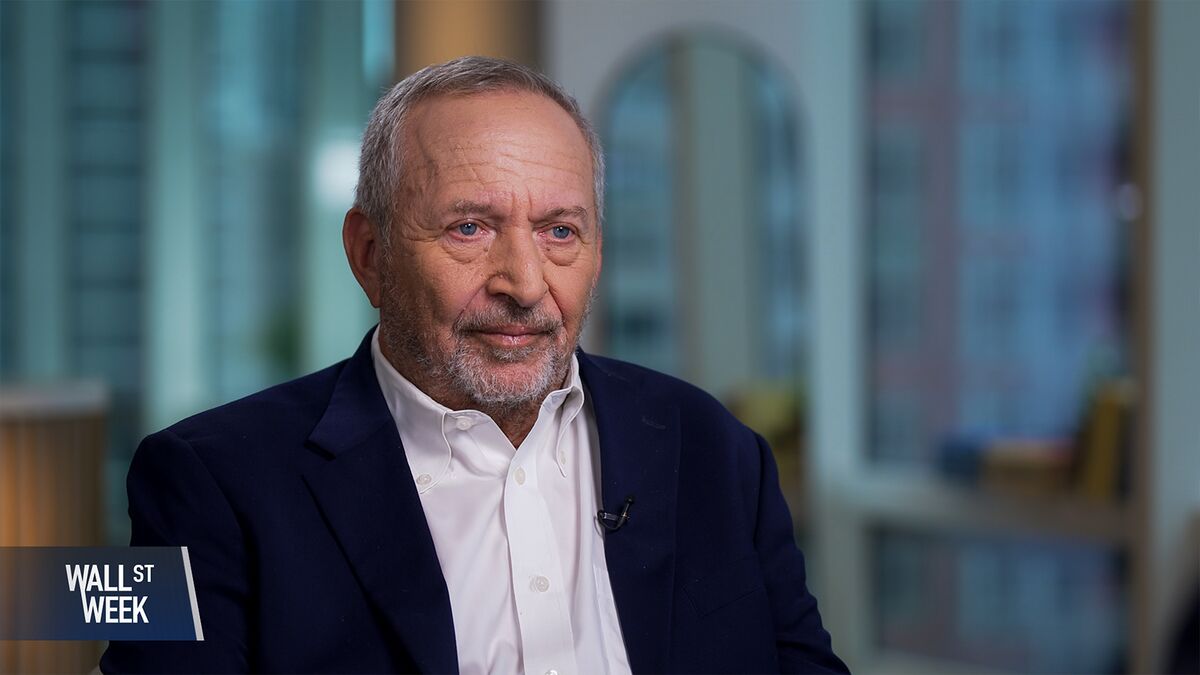

Bitter Pills | Summers on the Fed, Funding Fallout, Milei's Tough Policies, UK’s Growth Gamble

NeutralFinancial Markets

This week, former Treasury Secretary Lawrence H. Summers expressed concerns about the Federal Reserve's loose policy, suggesting it may lead to inflation risks. Meanwhile, MIT's Rafael Reif highlighted Massachusetts as a model for innovation funding as federal support wanes. Additionally, Argentine President Javier Milei faces challenges with his austerity measures following a significant electoral setback. These developments are crucial as they reflect broader economic trends and the impact of policy decisions on innovation and governance.

— Curated by the World Pulse Now AI Editorial System