Stock Market Today: Stocks slump as China retaliates against Trump

NegativeFinancial Markets

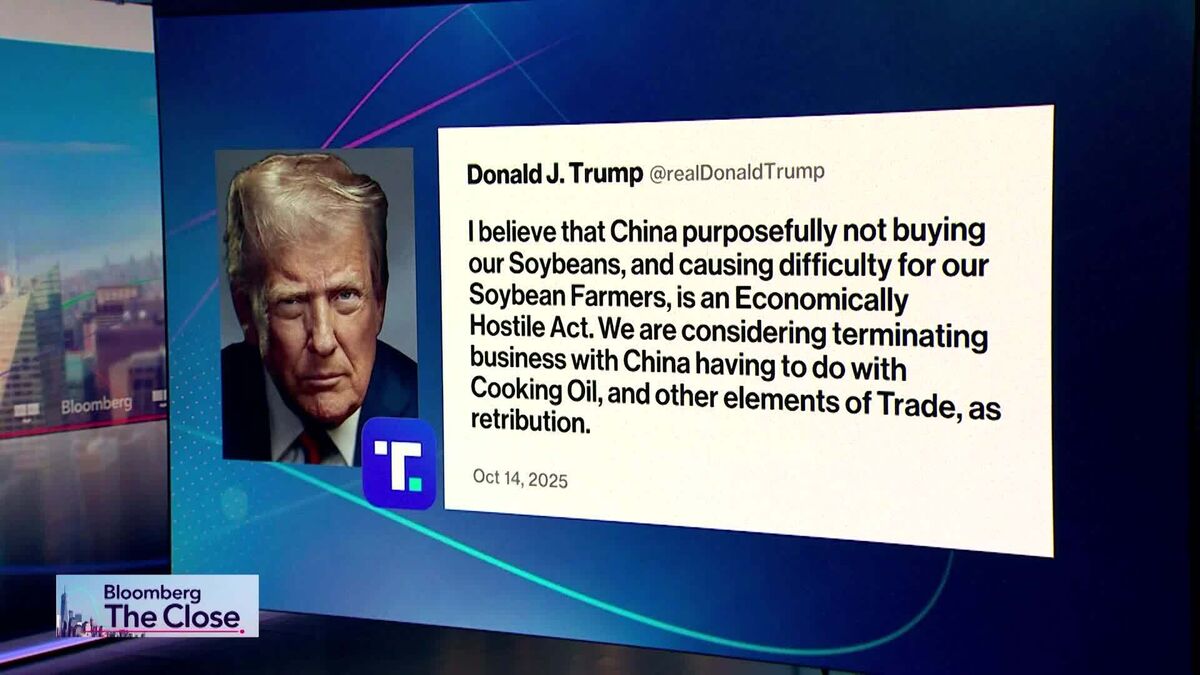

Today, the stock market took a hit as stocks fell significantly, erasing more than half of the gains made on Monday. This downturn is largely attributed to China's firm stance against President Trump's recent tariff threats, signaling that they won't back down in trade negotiations. This situation is crucial as it highlights the ongoing tensions between the two economic giants and the potential impact on global markets.

— Curated by the World Pulse Now AI Editorial System